Pooling Risks, Maximizing Value: Data-Driven Affordability in Modern Insurance

Revolutionizing Insurance with Data Science

In a world of rising risks and tightening margins, the old ways of underwriting just don’t cut it anymore. What if you could predict claims before they happen, price policies with pinpoint accuracy, and offer unbeatable affordability—all at once?

At Qubitstats, we fuse advanced data science with deep insurance expertise to turn uncertainty into opportunity. By leveraging predictive modeling, AI-driven insights, and risk-pooling strategies, we help insurers slash costs, boost profitability, and deliver hyper-personalized coverage—keeping you ahead in a fast-changing market.

The future of insurance isn’t just about managing risk—it’s about mastering it. Ready to transform your approach? Let’s dive in.

How Risk Pooling Enhances Affordability

Risk pooling isn’t new—it’s the backbone of insurance. But traditional methods often leave businesses overpaying or underserved. By infusing data-driven insights, we redefine risk pooling to deliver cost savings, precision, and peace of mind.

Why Businesses Need a Smarter Approach to Risk Management

Rising premiums, unpredictable risks, and opaque pricing models plague today’s insurance landscape. Companies crave solutions that cut through the noise—practical tools, clear insights, and measurable outcomes. That’s where Qubitstats steps in.

Understanding Risk Pooling

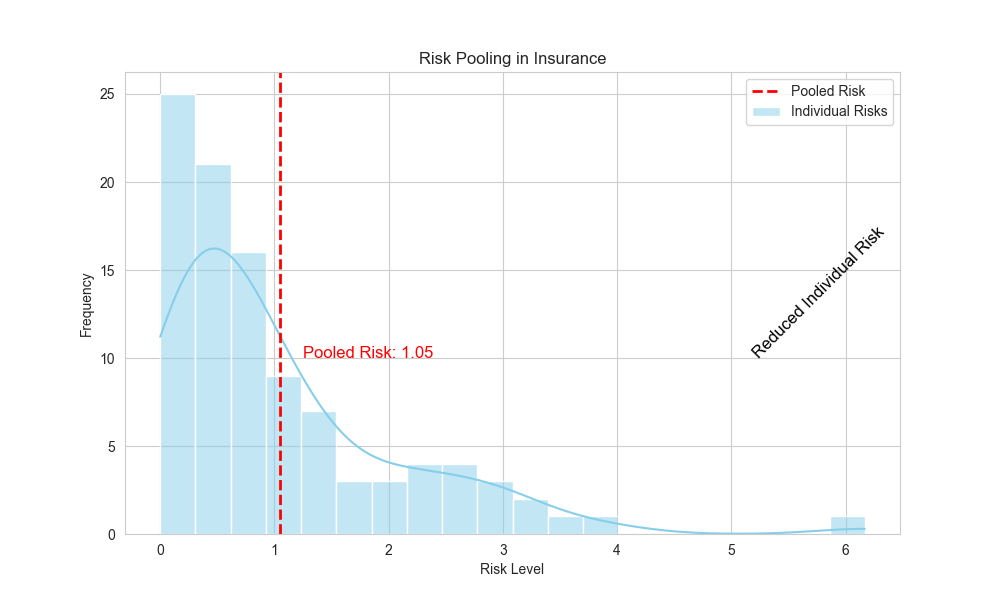

What Is Risk Pooling and Why Does It Matter?

At its core, risk pooling spreads the financial burden of uncertainty across a group, reducing the impact on any single entity. Think of it as a safety net: when one business faces a claim, the collective pool absorbs the cost. But here’s the catch—without data, this net can be riddled with holes, leaving gaps in coverage or inflated costs.

Traditional vs. Data-Driven Risk Pooling: A Comparison

| Aspect | Traditional Risk Pooling | Data-Driven Risk Pooling |

|---|---|---|

| Data Source | Historical claims, basic demographics | Real-time data, behavioral insights |

| Accuracy | Broad assumptions, limited precision | Granular, predictive analytics |

| Cost Efficiency | Higher premiums due to overestimation | Optimized pricing based on true risk |

| Customization | One-size-fits-all | Tailored to specific business profiles |

The Role of Big Data and AI in Insurance Pricing

Big Data and AI turn raw numbers into actionable intelligence. From weather patterns to customer behavior, we analyze millions of data points to fine-tune risk pools, ensuring you pay only for the risks you face—not someone else’s.

The Data Science Behind Risk Pooling

How Predictive Analytics Optimizes Risk Assessment

Imagine knowing a storm is coming before it hits. Predictive analytics does just that for insurance—forecasting risks with precision. By analyzing trends and anomalies, Qubitstats identifies potential threats early, enabling proactive adjustments to your risk pool.

Leveraging Machine Learning to Identify Risk Patterns

Machine learning doesn’t just crunch numbers—it learns from them. Our algorithms detect subtle patterns—like a spike in claims tied to specific industries or regions—and adapt risk models dynamically. The result? Smarter pricing and fewer surprises.

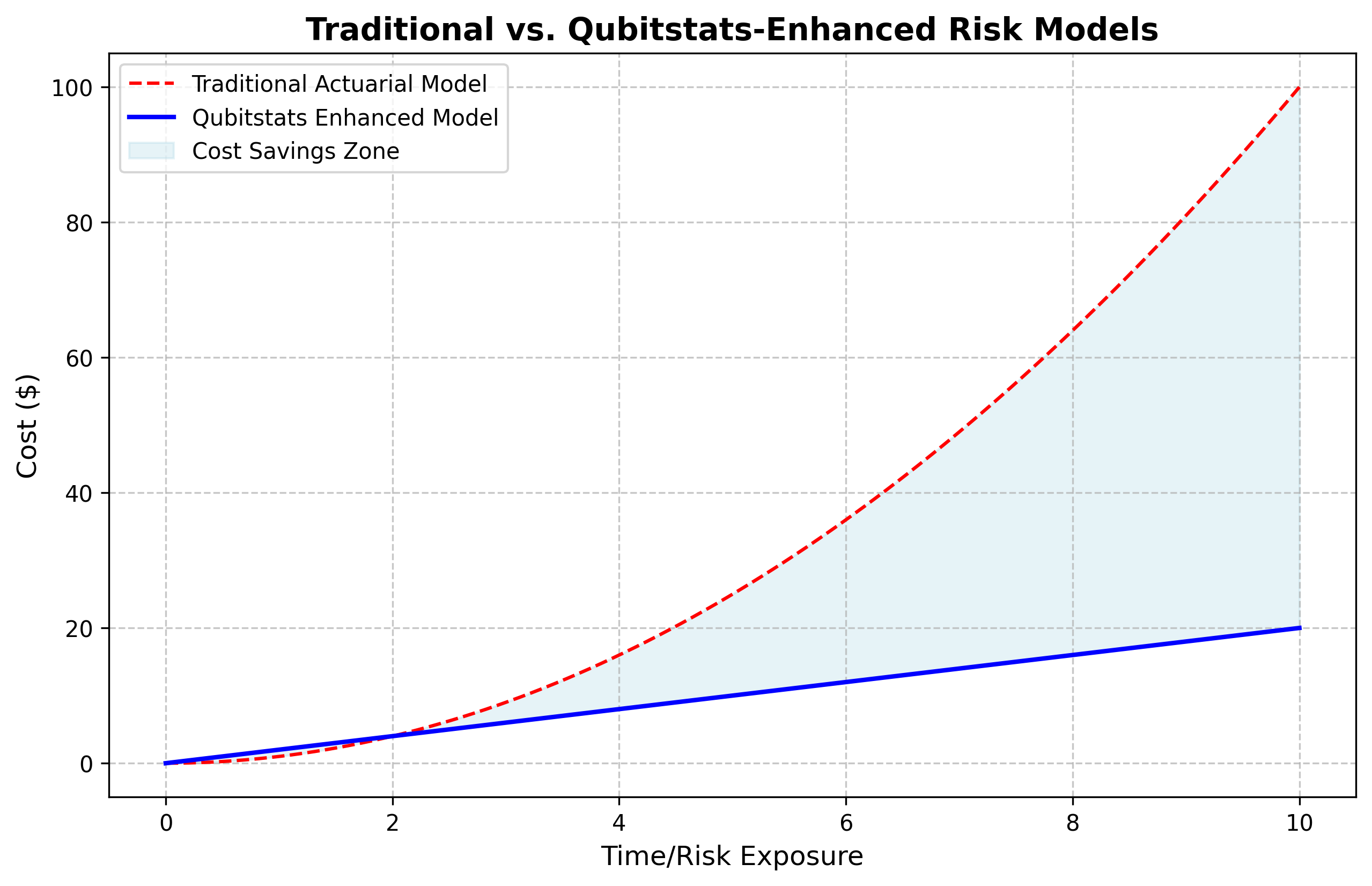

Enhancing Actuarial Models with Advanced Data Techniques

Traditional actuarial tables are static snapshots. We supercharge them with real-time data streams, geospatial analysis, and sentiment tracking from platforms like X. This creates a living, breathing model that evolves with your business.

Key Client Pain Points & How We Solve Them

Businesses don’t just want insurance—they want solutions. Here’s how Qubitstats tackles your biggest challenges:

High Premiums: How Data Science Lowers Costs

Overpaying for coverage is a thing of the past. By pinpointing true risk levels, we shrink bloated premiums—sometimes by double digits.

Inaccurate Risk Assessments: Improving Precision with AI

Generic risk profiles miss the mark. Our AI drills into your unique data—operations, location, industry trends—to craft a precise risk snapshot.

Lack of Transparency: Providing Clear, Data-Backed Insights

No more guessing games. We deliver dashboards and reports that break down your risk pool, showing exactly where your money goes.

Custom Solutions: Tailoring Insurance Plans to Business Needs

Whether you’re a retailer or a manufacturer, we design risk pools that fit your reality—not a cookie-cutter mold.

The Business Growth Impact

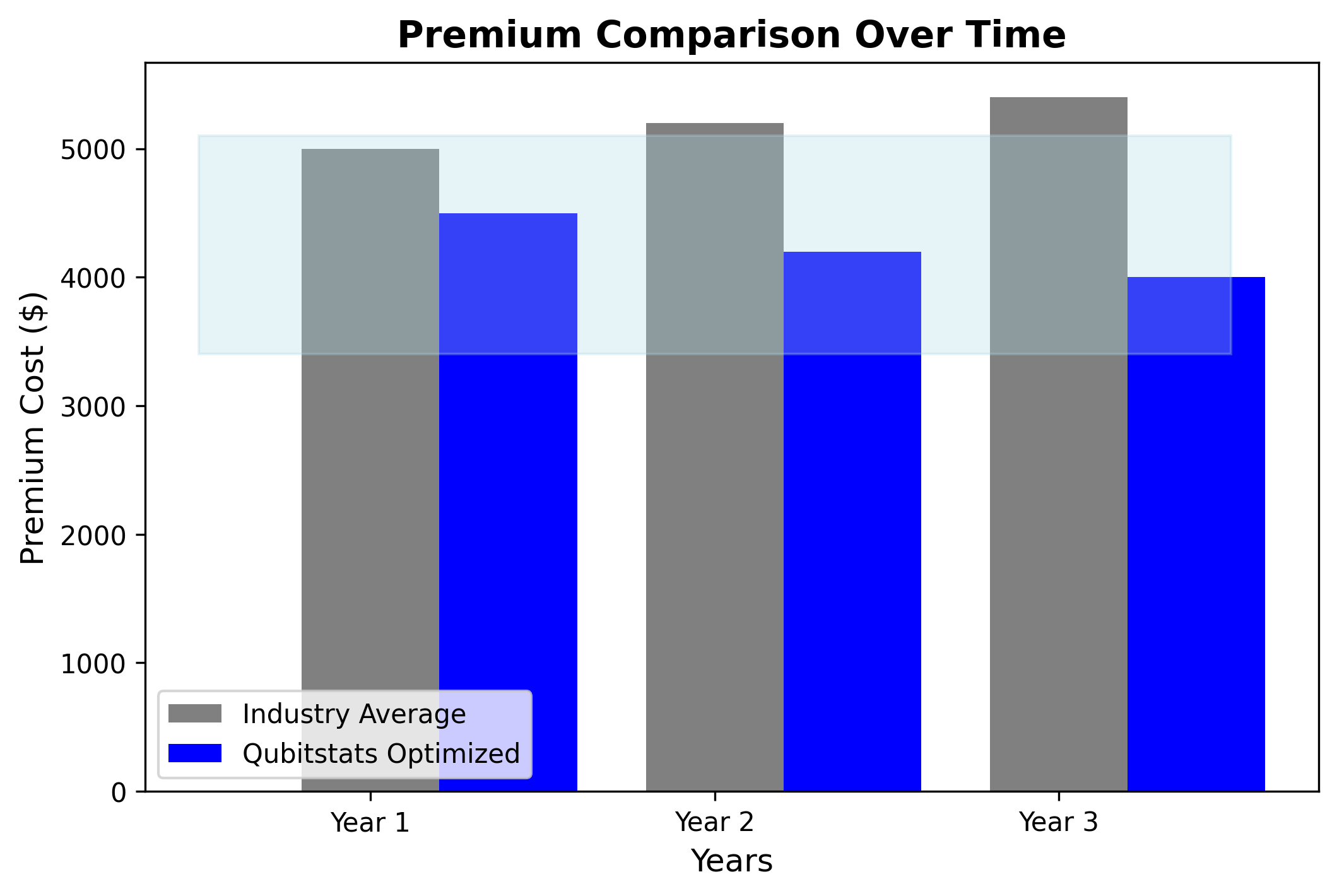

Cost Reduction Through Smarter Risk Distribution

Lower premiums free up capital—money you can reinvest in growth, not insurance overhead. Our clients have slashed costs by up to 25% without sacrificing coverage.

Improved Financial Stability with Data-Driven Decision Making

When risks are predictable, cash flow stabilizes. Our analytics empower you to plan with confidence, not caution.

Gaining Competitive Advantage with Optimized Premiums

Affordable, tailored insurance isn’t just a perk—it’s a market edge. Outpace competitors stuck with outdated models.

Enhancing Trust and Customer Satisfaction Through Transparency

Clients and stakeholders value clarity. Our transparent approach builds loyalty, turning insurance from a grudge purchase into a strategic asset.

Real-World Success Story

Case Study: How a Mid-Sized Retailer Cut Insurance Costs by 30%

A regional retail chain faced spiraling premiums due to generic risk pooling. Qubitstats stepped in, analyzing their sales data, foot traffic patterns, and regional theft trends. Using machine learning, we built a custom risk pool that dropped their costs by 30% in year one—saving $150,000 annually.

From High Premiums to Smart Risk Sharing: A Transformational Journey

- Before: Broad risk assumptions led to a 15% premium hike.

- After: Data-driven pooling aligned costs with actual risk, boosting profitability.

Key Takeaways: Lessons for Your Business

- Precision beats guesswork—data reveals the real story.

- Customization pays off—generic plans waste money.

- Transparency builds trust—knowing the “why” matters.

Why Choose Qubitstats’ Data-Driven Risk Pooling Service?

Proven Expertise in Data Science & Risk Modeling

Our team blends actuarial know-how with PhD-level data science, delivering results that stand up to scrutiny.

Customized Insurance Strategies for Every Business

No two companies are alike. We craft risk pools as unique as your fingerprint, maximizing value.

Cutting-Edge Technology for Smarter Decision-Making

From AI to cloud computing, our tech stack is built for speed, accuracy, and scalability.

Real Results: Data-Backed Success You Can Trust

We don’t just promise savings—we prove it. Our clients see measurable ROI, from cost cuts to risk reduction.

Take the Next Step

Get a Free Consultation: Discover Your Savings Potential

Curious how much you could save? Let’s talk. Our experts will assess your current plan and reveal untapped opportunities—no strings attached.

Request a Personalized Risk Assessment Today

See your risk profile through our lens. We’ll deliver a detailed report showing where data can transform your insurance strategy.

Join Businesses That Are Redefining Insurance with Data Science

Don’t settle for outdated models. Partner with Qubitstats and turn risk into opportunity.