Picture a world where life insurance evolves beyond a mere safety net into a finely tuned instrument, custom-built for your clients’ unique needs through cutting-edge data science. At Qubitstats, we revolutionize the intricate task of determining life insurance face value, delivering a streamlined, insightful, and impactful experience. Our sophisticated analytics go beyond number-crunching to reveal practical solutions, provide actionable insights, and generate measurable results for insurers and policyholders. Discover how we redefine this vital process and why it’s a game-changer for your business.

Decoding Life Insurance Face Value: The Foundation of Coverage

What Is Life Insurance Face Value?

The face value of a life insurance policy is the payout amount promised to beneficiaries upon the policyholder’s passing—think of it as the policy’s core promise. It’s the number that defines coverage, shapes premiums, and anchors financial planning.

Face Value vs. Cash Value: A Clear Distinction

Unlike cash value, which grows over time in permanent policies as an investment component, face value remains fixed (unless adjusted). Confusing the two can lead to misaligned expectations. At Qubitstats, we ensure clarity by modeling both components with precision.

Why Face Value Matters

It’s the bedrock of trust between insurers and clients. An accurate face value ensures beneficiaries receive what they’re promised—no more, no less—while keeping premiums fair and sustainable.

The High Stakes of Precision in Face Value Calculation

The Cost of Missteps

Underestimate face value, and beneficiaries suffer. Overestimate it, and premiums skyrocket, driving customers away. Our data-driven approach eliminates guesswork, safeguarding both policyholders and your bottom line.

Inflation and Market Volatility: Hidden Challenges

A policy written today might not hold the same purchasing power in 20 years. We integrate inflation forecasts and market trends to future-proof face value estimates.

Regulatory Guardrails

Compliance isn’t optional—regulators demand transparency and accuracy. Our solutions align with industry standards, reducing legal risks and ensuring audit-ready calculations.

Data Science: The Engine Behind Smarter Face Value Calculations

Predictive Analytics for Precision

Using historical data and predictive models, we forecast mortality rates, health trends, and economic shifts to refine face value estimates. It’s like giving actuaries a crystal ball—only better, because it’s grounded in data.

Machine Learning in Risk Assessment

Our AI algorithms analyze thousands of variables—age, medical history, even social determinants of health—to assess risk with unparalleled accuracy. This means sharper pricing and fewer surprises.

Actuarial Science Meets Analytics

Traditional actuarial tables get a modern upgrade with real-time data feeds and machine learning, blending time-tested methods with cutting-edge innovation.

The Building Blocks of Face Value Calculation

Here’s what goes into the equation—and how we optimize it:

Age and Health Status: Younger, healthier clients need different coverage than older, high-risk individuals. We use granular data to personalize calculations.

Coverage Duration and Policy Type: Term life or whole life? Short-term or lifelong? Each demands a tailored approach.

Lifestyle and Occupational Risks: A firefighter’s policy differs from a desk worker’s. Our models factor in these nuances.

Inflation and Future Value: We project purchasing power decades ahead, ensuring policies stay relevant.

Key Factors at a Glance

| Factor | Impact on Face Value | Qubitstats’ Edge |

|---|---|---|

| Age & Health | Higher risk = Higher value | AI-driven health scoring |

| Policy Type | Permanent > Term | Dynamic modeling for flexibility |

| Lifestyle Risks | High risk = Higher cost | Real-time risk adjustment |

| Inflation | Erodes value over time | Predictive economic forecasting |

Qubitstats’ Data Science Solutions: Precision Meets Practicality

Automation for Efficiency

Manual calculations are slow and error-prone. Our automated tools process data in real time, delivering accurate face values faster than ever.

Custom AI Models

No two insurers are alike. We build bespoke AI solutions that reflect your unique risk profiles, customer base, and business goals.

Real-Time Data Integration

From wearable health trackers to economic indicators, we pull live data into our models, ensuring face values adapt to changing realities.

Business Wins with Advanced Face Value Calculation

Optimized Premiums, Bigger Profits

Accurate face values mean competitive pricing without sacrificing margins. Our clients see profitability soar as underwriting aligns with reality.

Lower Underwriting Risks

Data-driven insights reduce overexposure to high-risk policies, protecting your balance sheet.

Happier Customers

Personalized policies based on precise calculations boost satisfaction and retention—clients feel understood and valued.

Compliance Made Simple

Transparent, auditable processes keep regulators off your back and fines at bay.

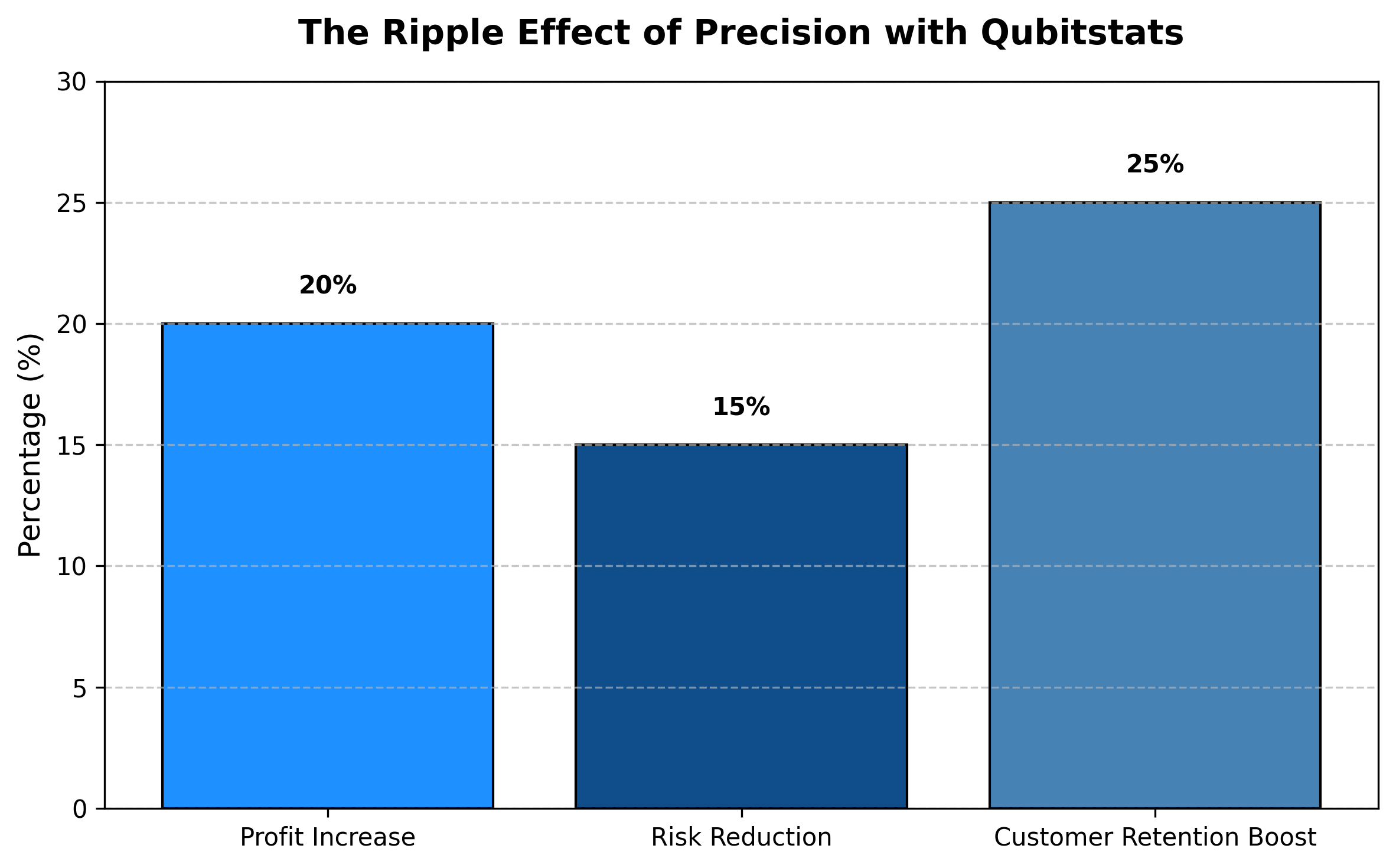

The Ripple Effect of Precision

Real-World Impact: A Success Story

Case Study: Pinnacle Life Insurance

Before partnering with Qubitstats, Pinnacle struggled with outdated face value estimates, leading to frequent claim disputes and customer churn. After implementing our AI-driven platform:

- Accuracy Improved by 30%: Predictive models cut miscalculations.

- Claim Disputes Dropped 40%: Beneficiaries got what they expected.

- Retention Climbed 25%: Satisfied clients stayed longer.

Before vs. After

| Metric | Before Qubitstats | After Qubitstats |

|---|---|---|

| Calculation Time | 5 Days | 2 Hours |

| Error Rate | 12% | 3% |

| Customer Complaints | 18% | 5% |

Why Qubitstats Stands Out

- Proven Expertise: Decades of experience in insurance analytics, distilled into every solution.

- Cutting-Edge Tech: Our AI and ML models evolve with the industry, keeping you ahead.

- Tailored Fit: Scalable, customizable tools designed for your specific challenges.

- Trusted Results: Leading insurers rely on us for compliance, accuracy, and growth.

Take the Next Step Today

Ready to revolutionize your life insurance face value calculations? Partner with Qubitstats and turn data into your competitive edge.

- Book a Free Consultation: Meet our experts and explore your potential.

- Get a Custom Strategy: Receive a roadmap tailored to your business.

- Join the Leaders: Align with top insurers who trust Qubitstats to deliver.

Let’s transform complexity into clarity—together. Contact us now and see why Qubitstats is the partner you’ve been searching for.