In an era where uncertainty looms large, insurance has evolved beyond mere protection—it’s now a strategic tool powered by precision, predictability, and performance. At Qubitstats, we don’t just assess risk; we redefine it. By leveraging cutting-edge data science and advanced analytics, we transform traditional premium calculations and risk evaluations into dynamic, actionable strategies.

Our mission? To equip you with smarter insights, measurable savings, and tailored solutions that don’t just meet your needs—they anticipate them. Whether you’re looking to optimize costs, mitigate risks, or unlock growth, our approach turns complex data into your competitive advantage.

Understanding the Core: How Insurance Premiums Are Calculated

Leveraging Data Science to Decode Premium Pricing

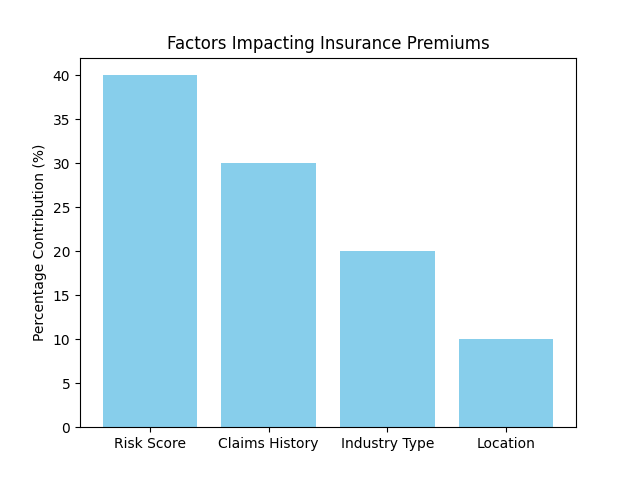

Insurance premiums aren’t arbitrary—they’re a mathematical reflection of risk. By analyzing historical claims data, demographic trends, and behavioral patterns, insurers determine pricing. But with advanced analytics, businesses can challenge assumptions, uncover hidden savings, and negotiate better rates.

The Role of Risk Assessment in Shaping Costs

Risk assessment is the backbone of insurance pricing. The higher the perceived risk, the steeper the premium. But what if you could quantify risk with surgical precision?

Did you know? A 10% improvement in risk assessment accuracy can reduce premiums by up to 15%!

Key Variables That Drive Your Insurance Premiums:

- Claims History (Frequency & Severity)

- Industry-Specific Risks (e.g., cybersecurity threats for tech firms)

- Geographic Factors (Natural disaster-prone areas cost more)

- Operational Practices (Safety protocols lower premiums)

- Market Trends (Inflation, regulatory changes)

The Power of Risk Assessment in Insurance

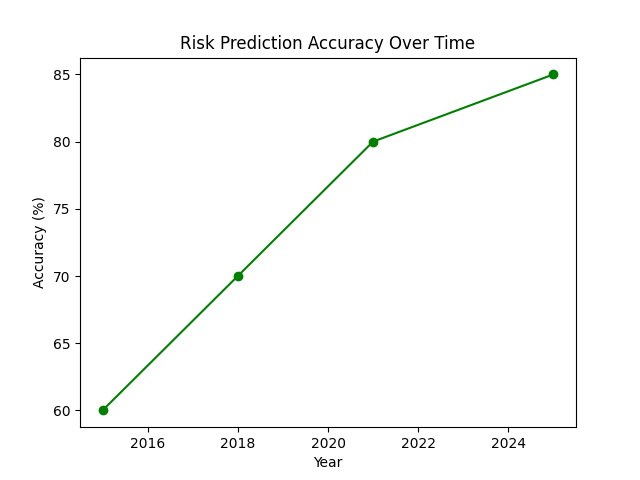

Predictive Analytics: Anticipating Risks Before They Happen

Gone are the days of reactive insurance. With predictive modeling, we forecast risks before they materialize, allowing businesses to preempt losses and reduce premiums.

From Uncertainty to Clarity: Quantifying Risk with Precision

Traditional risk assessment relies on broad categories, but machine learning breaks risk into micro-segments, ensuring fairer, more accurate pricing.

How Advanced Models Mitigate Financial Exposure:

- Fraud Detection (AI flags suspicious claims)

- Dynamic Pricing (Premiums adjust in real-time based on risk shifts)

- Catastrophe Modeling (Predicts natural disaster impacts)

- Real-World Example: A logistics company reduced premiums by 15% after implementing IoT-driven driver safety analytics.

Why Clients Care: Key Insights You Need to Know

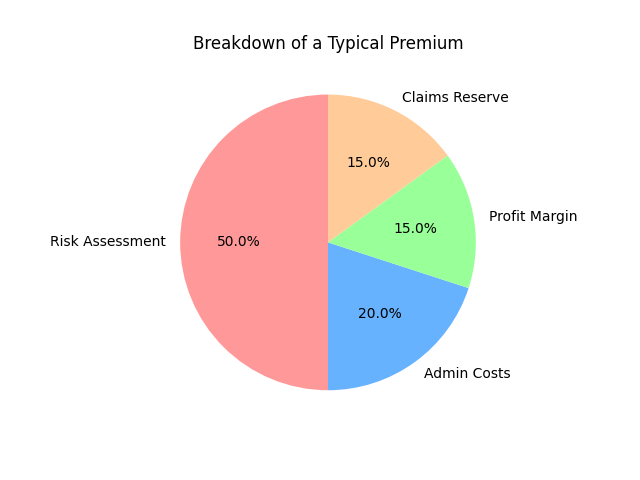

Transparency in Pricing: What’s Behind Your Premium?

Clients demand clarity. We decode the black box of insurance pricing, revealing actionable ways to lower costs.

Reducing Costs Through Smarter Risk Management

- Risk Mitigation Programs (Lower premiums via safety investments)

- Alternative Risk Transfer (Captive insurance, parametric policies)

- Data-Backed Negotiations (Leverage analytics for better terms)

Tailored Solutions for Your Unique Risk Profile

No two businesses face identical risks. Our custom models align coverage with your specific exposures.

Driving Business Growth with Data-Driven Insurance Strategies

Optimizing Premiums to Boost Profit Margins

Every dollar saved on insurance goes straight to your bottom line. Our analytics identify overpayments and coverage gaps.

Minimizing Risks, Maximizing Opportunities

Insurance isn’t just a cost—it’s a strategic tool. Companies using predictive risk analytics experience:

- 30% fewer claims

- 20% lower premiums

- Faster claims processing

How Analytics Turns Insurance into a Growth Engine

By reducing volatility, businesses can invest confidently, expand operations, and secure financing at better rates.

With analytics, we cut our risk exposure by 25% and reinvested the savings into expansion.’ – CEO, TechCorp.

The Technology Edge: Tools Powering Modern Risk Assessment

Machine Learning: Self-improving algorithms refine risk predictions over time.

Real-Time Data: IoT and telematics provide live risk monitoring.

AI Integration: Chatbots streamline underwriting, while NLP analyzes unstructured data.

Benefits for Your Business: Why Our Approach Works

- Customized Premiums – Pay only for the coverage you need.

- Proactive Risk Mitigation – Stop losses before they happen.

- Scalable Solutions – Grow without outgrowing your policy.

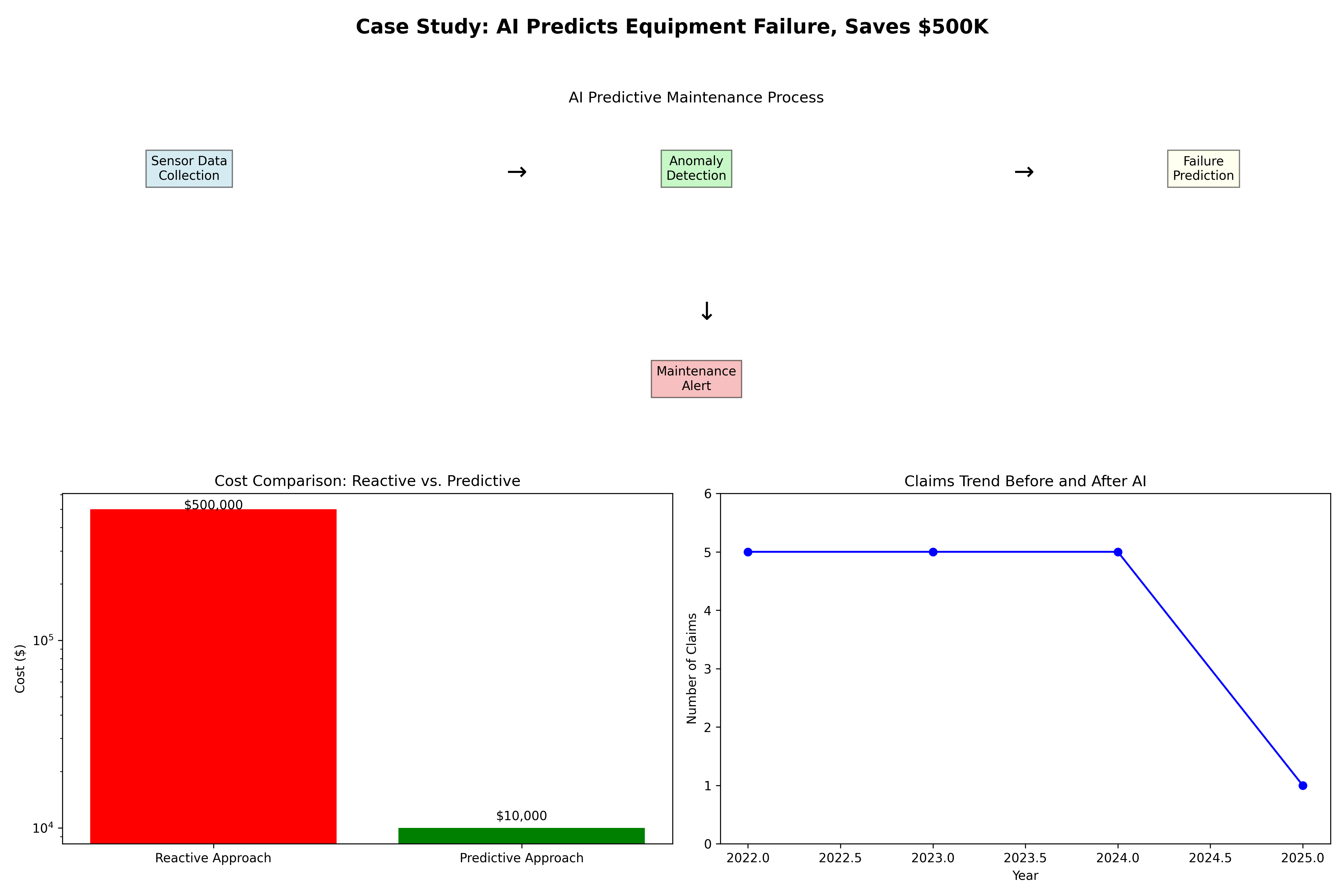

Real-World Impact: A Case Study in Action

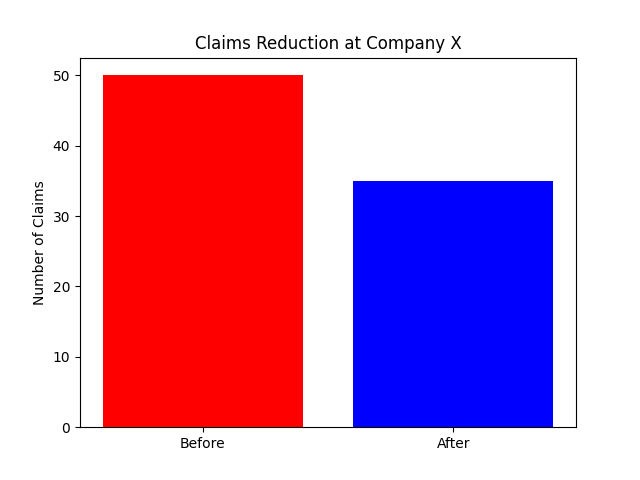

How Company X Saved 20% on Premiums with Data Analytics

Challenge: A mid-sized retailer faced spiraling insurance costs due to high theft-related claims.

Solution:

- Deployed predictive analytics to identify high-risk stores.

- Implemented AI-powered surveillance & inventory tracking.

- Negotiated premiums based on provable risk reduction.

Result:

- 20% lower premiums

- 35% drop in theft incidents

- Faster claims resolution

Reducing Claims Through Predictive Risk Assessment

A healthcare provider partnered with us to tackle rising malpractice claims. Our risk models flagged high-risk procedures, enabling targeted training programs that slashed claims by 25%.

From Reactive to Proactive: A Success Story

An e-commerce company prone to warehouse fires implemented our IoT-enabled risk monitoring system. Early detection alerts prevented multiple incidents, saving millions in potential damages.

Their analytics transformed how we manage risk. We’re saving more and growing faster.’ – CFO, RetailChain

Making the Decision: Why Partner with Us?

- Unmatched Expertise – Data scientists + insurance specialists = optimal outcomes.

- Proven Results – Track record of cost savings & risk reduction.

- Your Partner in Turning Risk into Opportunity – Because insurance should empower, not hinder, your growth.

Ready to Transform Your Insurance Strategy? Contact Qubitstats Today.

Book a Free Consultation | Get a Custom Quote

Data doesn’t lie—let it work for you.