Crafting a Strong Financial Future: The Power of Smart Budgeting & Planning

In an era of economic uncertainty, financial stability is more than a goal—it’s a necessity. Whether you’re a small business owner, a family managing household expenses, or a financial professional seeking smarter strategies, the challenges remain the same: How do I curb unnecessary spending? Where can I find room to save? Am I prepared for the unexpected?

At Qubitstats, we believe the answer lies in data-driven decision-making. By harnessing advanced analytics and financial insights, we turn uncertainty into opportunity—helping you build confidence, control, and a roadmap to long-term success. Here’s how we empower you to master your finances, one smart decision at a time.

Sticking to Budgets: How Data Science Can Transform Your Financial Discipline

Why Traditional Budgeting Fails and What Data Analytics Can Do Differently

Traditional budgeting—scribbling numbers on paper or tracking expenses in a spreadsheet—often falls short. Why? It’s static, reactive, and prone to human error. Studies show that 60% of people abandon their budgets within three months due to unrealistic goals or lack of visibility into spending habits.

With Qubitstats’ data analytics, we flip the script:

- Predictive Analytics: We analyze your historical spending data to uncover patterns—like that sneaky $100 monthly coffee habit—and forecast future trends.

- Custom Budget Models: Tailored to your income, lifestyle, and goals, our models adapt as your circumstances change.

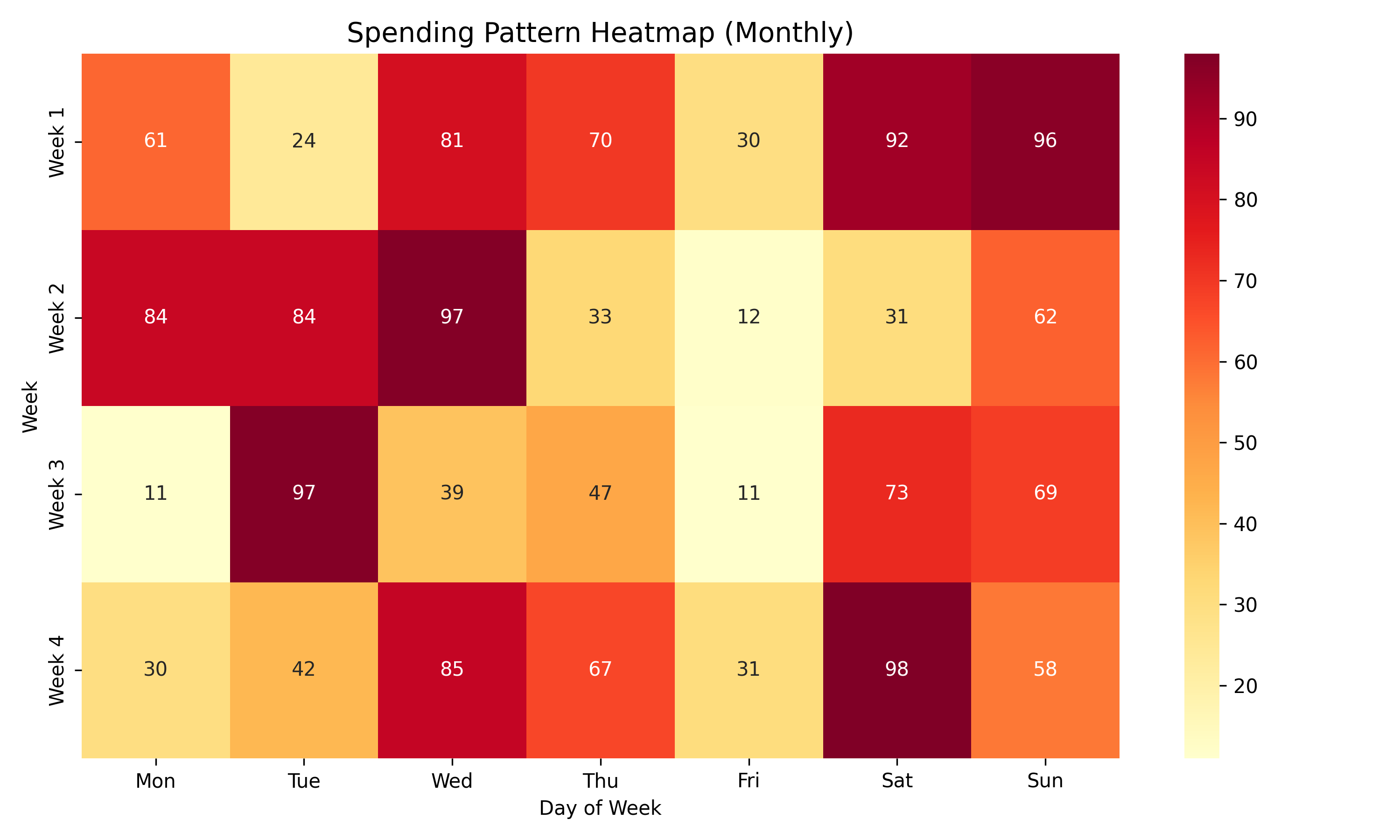

Visual Insight: Imagine a Spending Pattern Heatmap highlighting peak expenditure days (e.g., weekends) in red, guiding you to adjust habits proactively.

Leveraging AI-Powered Tools for Real-Time Spending Alerts

Overspending doesn’t announce itself—it creeps up. Our AI-driven tools act as your financial guardian:

- Real-Time Monitoring: Machine learning algorithms track every transaction, flagging anomalies instantly (e.g., a $200 impulse buy).

- Actionable Alerts: Get a text like, “You’re 80% through your dining budget—adjust now?” before it’s too late.

Client Benefit: Prevent budget overruns with precision, saving you an average of 10-15% monthly, according to our case studies.

When Monthly Spending Exceeds Income: A Data-Driven Path to Balance

Uncovering Hidden Expenses with Advanced Spend Analysis

Ever wonder where your money goes? Our advanced analytics peel back the layers:

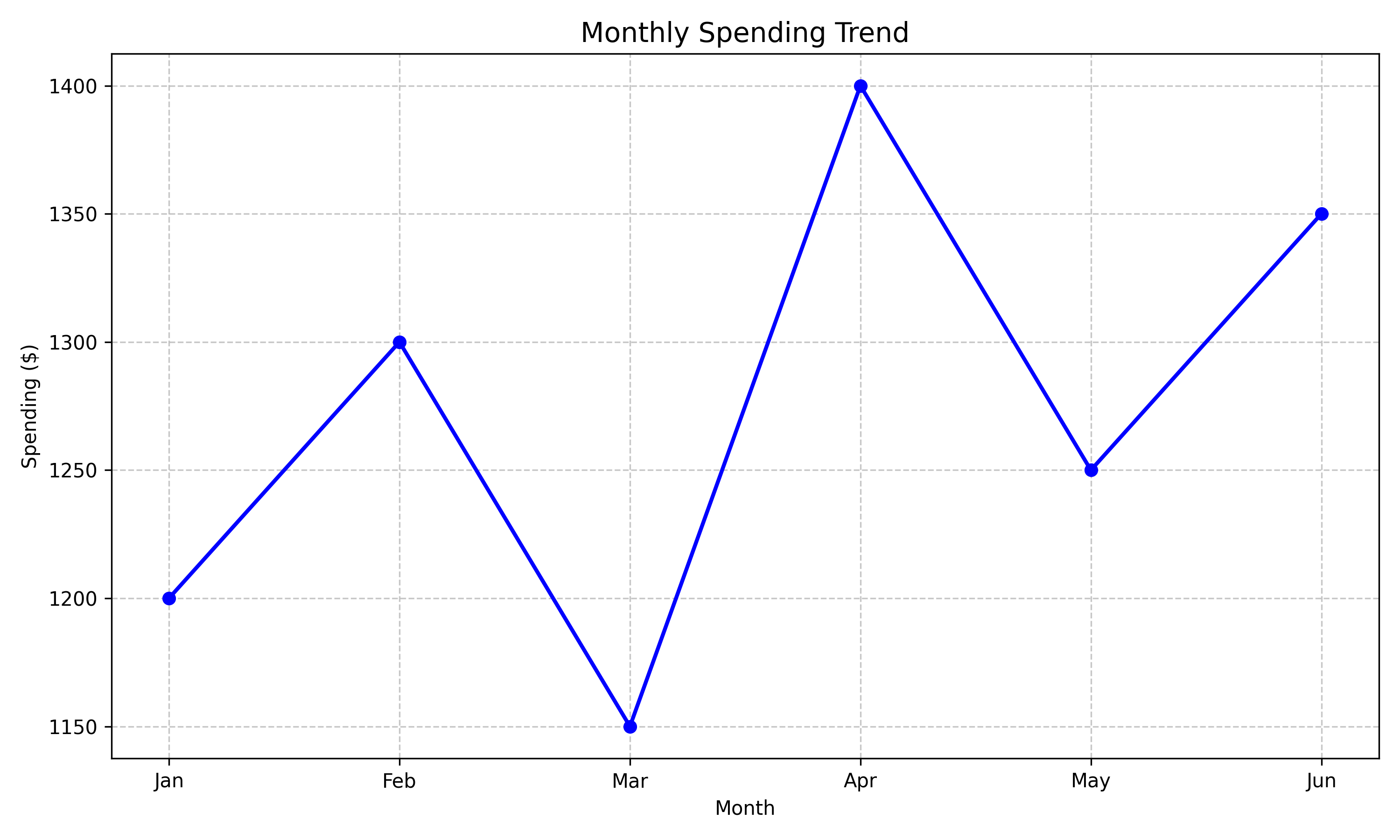

- Data Visualization: A Trend Chart tracks spending over months, while a Heatmap pinpoints categories like subscriptions or impulse buys eating into your income.

- Key Finding: Clients often discover $50-$200/month in forgotten costs (e.g., unused gym memberships).

Optimizing Cash Flow Using Predictive Modeling

Stop guessing—start planning. We use time-series forecasting to:

- Predict income dips (e.g., seasonal slowdowns for freelancers).

- Forecast expenses (e.g., holiday spikes).

- Recommend actions like transferring $300 to savings when a surplus is detected.

Precision Planning: Building a Robust Financial Strategy with Analytics

From Chaos to Clarity: Structuring Goals with SMART Frameworks Enhanced by Data

Vague goals like “save more” don’t stick. We refine them with SMART principles (Specific, Measurable, Achievable, Relevant, Time-bound) and back them with data:

- Example Goal: “Save $10,000 for a home down payment in 18 months by cutting dining costs 20%.”

- Interactive Dashboards: Track progress with real-time updates—watch your savings bar climb!

Scenario Analysis for Risk Mitigation in Financial Planning

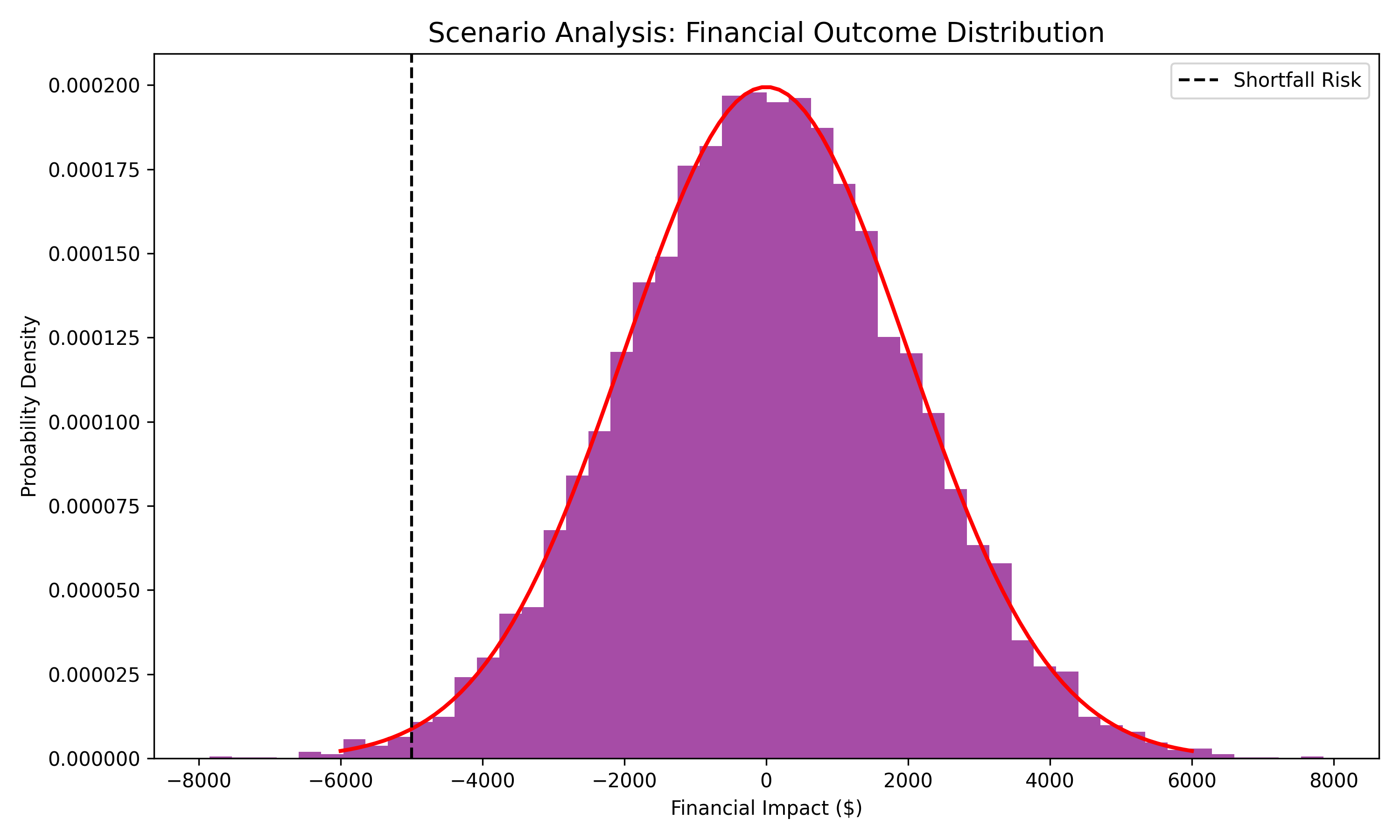

What if inflation spikes or you lose a client? Our Monte Carlo simulations run 1,000+ scenarios to:

- Quantify risks (e.g., 70% chance of a $5,000 shortfall in 2025).

- Build contingency plans—like a $2,000 buffer fund.

Visual Aid: A probability curve showing potential outcomes, helping you prepare with confidence.

Spend Management and Cost Control: The Role of Analytics in Maximizing Resources

Identifying High-Impact Areas for Cost Reduction Through Cluster Analysis

Not all expenses are equal. Our cluster analysis groups spending into buckets—essentials, discretionary, luxuries—revealing savings goldmines:

- Finding: Clients cut 12% of costs by targeting low-value categories like premium subscriptions.

- Prioritization: Focus on big wins without sacrificing quality of life.

Vendor Negotiation Strategies Backed by Benchmark Data

Paying too much for utilities or insurance? We arm you with:

- Industry Benchmarks: Compare your $150/month internet bill to the $120 regional average.

- Negotiation Leverage: Use our competitive pricing database to secure better deals.

Result: One client saved $1,200/year on vendor contracts after a 10-minute data-backed negotiation.

Not Saving Enough? Data-Backed Solutions to Boost Your Savings Rate

Behavioral Insights to Overcome Psychological Barriers to Saving

Why do we undersave? Behavioral economics reveals it’s often instant gratification seeking. Our tools counter this:

- Nudges: A notification saying, “Save $50 today, enjoy $500 later!”

- Habit Tracking: See how small changes (e.g., skipping takeout twice a week) compound over time.

Automated Savings Plans Tailored to Your Financial Profile

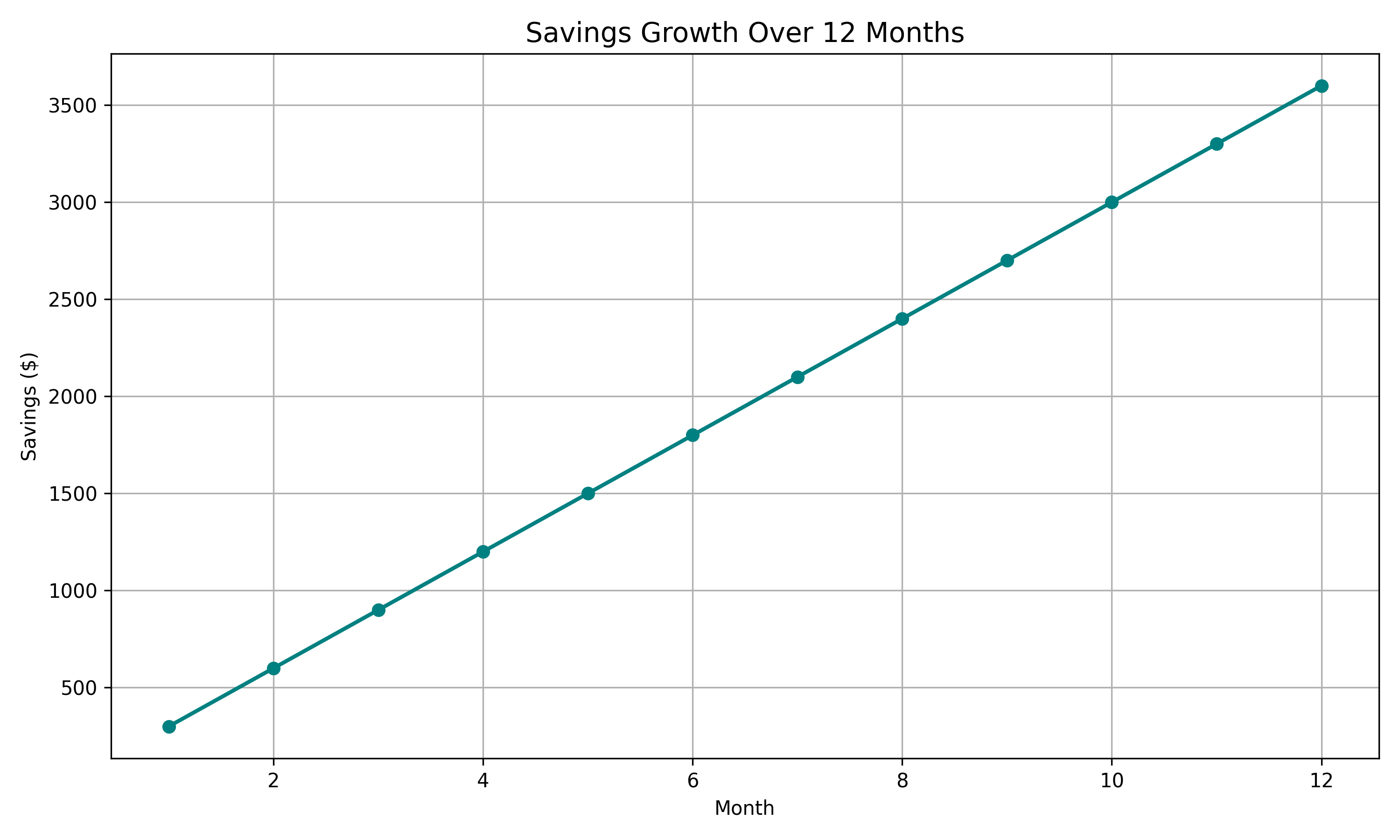

No two wallets are alike. Using regression analysis, we craft savings plans:

- Personalized Targets: Save $300/month based on your income-expense ratio.

- Automation: Transfer funds to emergency or retirement accounts seamlessly.

Chart Idea: A Savings Growth Curve showing $0 to $5,000 over 12 months with automated contributions.

Lack of Contingency Planning: Why Emergency Funds Are Non-Negotiable

Quantifying the Risks of Not Having an Emergency Fund

Life is unpredictable—medical bills, car repairs, or job loss can strike anytime. We quantify this:

- Risk Estimate: A $2,000 emergency has a 40% likelihood in any given year (per probability models).

- Impact: Without a fund, you’re forced into debt, costing $500+ in interest annually.

Building an Emergency Fund Strategically with Incremental Goal Setting

Start small, win big:

- Plan: Save $100/month to reach $3,000 in 2.5 years.

- Motivation: Our interactive Fund Growth Tracker shows your progress in real-time, keeping you on track.

Real-World Example: How a Retail Business Achieved Financial Stability Through Analytics

Case Study: From Financial Strain to Sustainable Growth

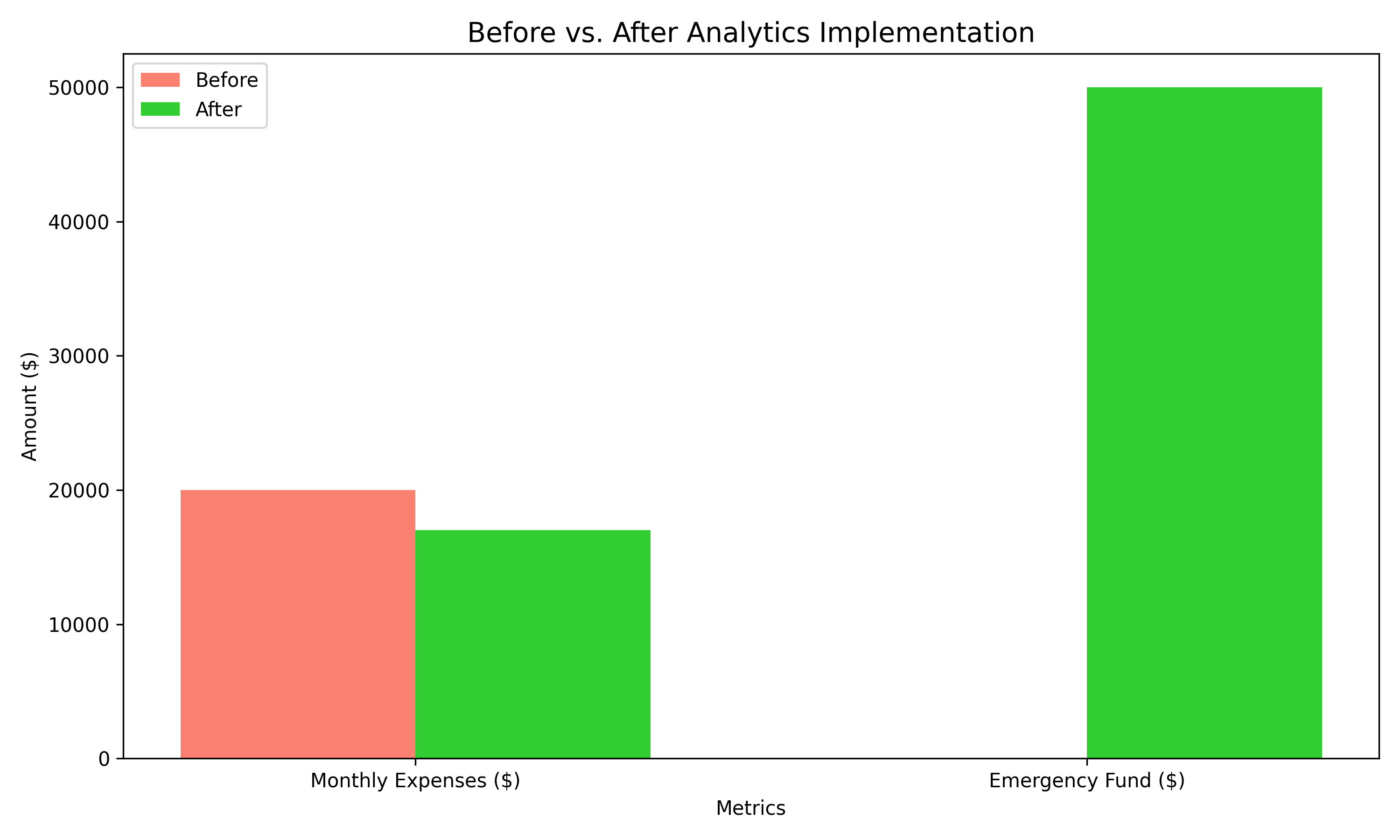

Background: A mid-sized retail chain faced cash flow chaos—$20,000/month in operational costs dwarfed their $18,000 revenue.

Qubitstats Solution:

- Deployed spend management software with predictive analytics.

- Identified $3,000/month in redundant supplier fees via cluster analysis.

- Forecasted sales dips, automating $1,000 monthly savings transfers.

Results: Increased Profit Margins and Improved Liquidity

- Cost Savings: Reduced expenses by 15% ($3,000/month).

- Emergency Fund: Built a $50,000 cushion in six months.

- Growth: Reinvested savings into marketing, boosting revenue by 20%.

Visual: A Before vs. After Bar Chart showing expense reduction and fund growth.

Empowering Your Financial Future with Data Analytics

Key Takeaways for Clients Seeking Financial Stability

- Overspending: Real-time alerts and spend analysis stop leaks.

- Savings: Automated plans and behavioral nudges build wealth.

- Planning: Predictive models and scenario analysis ensure resilience.

- Continuous Improvement: Our tools evolve with your needs.

Next Steps: Partnering with Qubitstats to Unlock Your Financial Potential

Ready to transform chaos into control? Qubitstats offers:

- Consultations: Work with our data scientists to tailor solutions.

- Tools: Access dashboards, trackers, and AI alerts.

- Get Started: or explore our.