Data-Driven Strategies for Effective Debt Repayment

Managing debt effectively is a critical skill for individuals and businesses alike. Whether you’re juggling personal loans, credit card balances, or business financing, the right strategies can lighten your financial load and pave the way to stability. Visitors to this page are likely seeking practical, actionable advice to tackle debt, improve credit health, and regain control of their finances. They want clear explanations, proven solutions, and real-world proof that these strategies work. Below, we’ll explore every angle of debt management, enriched with examples, visuals, and insights to leave you informed and empowered.

1. Understanding Debt and Its Impact

Debt is a double-edged sword—it can fuel growth or spiral into a burden. Let’s break down its role and consequences.

The Role of Debt in Personal and Business Finances

Debt can be a tool for opportunity, like funding a home, education, or business expansion. However, when mismanaged, it becomes a weight that drags down financial progress. For individuals, it might mean stretching paychecks thin; for businesses, it could limit cash flow for innovation.

How Poor Debt Management Affects Credit Health

Missed payments or high credit utilization can tank your credit score, making future borrowing costlier. A low score signals risk to lenders, leading to higher interest rates or loan denials.

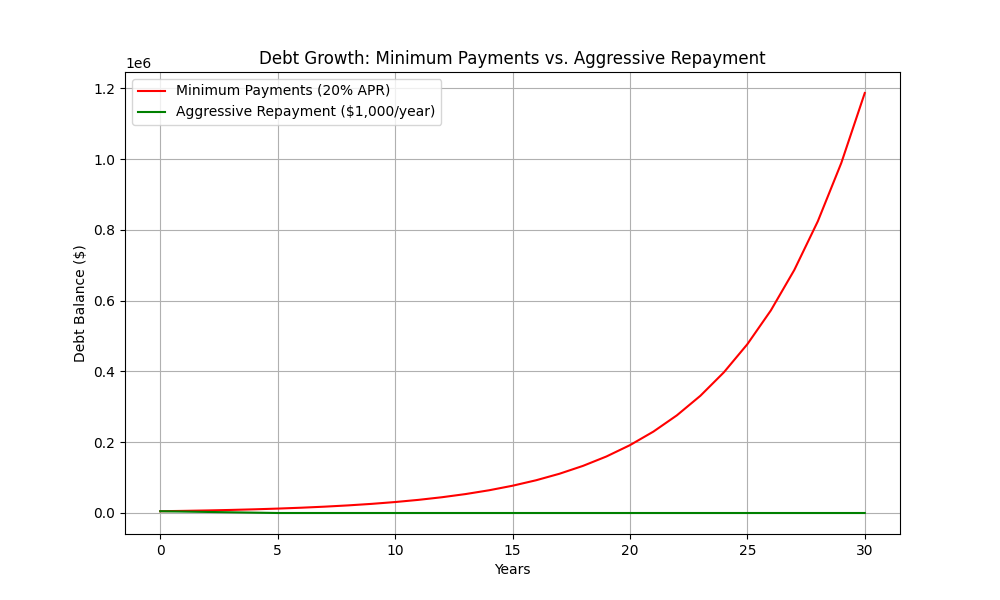

The Long-Term Consequences of High-Interest Debt

High-interest debt, like credit card balances, compounds quickly. For example, a $5,000 balance at 20% APR, with only minimum payments, could take over 30 years to pay off, costing nearly $15,000 in interest alone.

2. Common Debt Challenges and Pitfalls

Debt troubles often stem from habits or missteps that visitors may recognize in their own lives.

Struggling with Monthly Payments: The Warning Signs

Are you dipping into savings or skipping bills to cover debt? These are red flags that your debt load exceeds your income’s capacity.

The Dangers of Delinquent Bill Payments

Late payments don’t just rack up fees—they damage your credit for up to seven years. One missed payment can drop a good score by 100 points.

Over-Reliance on Credit Cards: A Risky Habit

Using cards for daily expenses can lead to balances you can’t clear. The average American carries $6,000 in credit card debt—small charges add up fast.

The Cost of Ignoring Retirement Savings While Managing Debt

Focusing solely on debt repayment can starve your retirement funds. A 30-year-old skipping $200 monthly contributions could lose over $250,000 by age 65, assuming a 7% return.

Recognizing these pitfalls is the first step to avoiding them.

3. Data-Driven Debt Management Solutions

Modern technology transforms debt management from guesswork to precision. Here’s how.

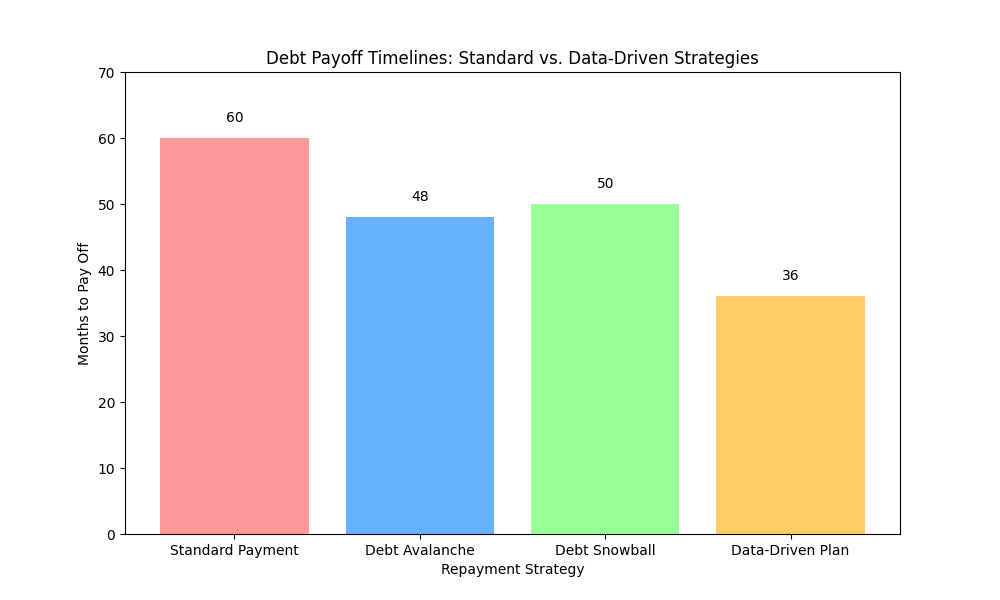

Using Data Analytics to Optimize Debt Repayment Plans

By analyzing income, expenses, and debt details, analytics pinpoint the fastest payoff paths—like the debt avalanche method (highest interest first) or snowball method (smallest balance first).

Predictive Modeling for Debt Reduction Strategies

Models forecast how changes (e.g., extra payments or rate reductions) impact your timeline. For instance, adding $100 monthly to a $10,000 loan at 10% cuts repayment from 5 years to 3.

AI and Machine Learning for Personalized Financial Recommendations

AI tailors advice to your unique situation—suggesting when to refinance, consolidate, or negotiate with creditors based on market trends and your financial profile.

4. How Our Data-Driven Approach Helps You

Our service isn’t one-size-fits-all—it’s built for you. Here’s what visitors can expect.

Tailored Debt Repayment Strategies Based on Financial Data

We analyze your debts, income, and goals to craft a plan that fits. Whether it’s tackling high-interest loans or spreading payments, it’s your roadmap.

Credit Health Monitoring and Improvement Strategies

We track your score and suggest moves—like lowering utilization below 30%—to boost it steadily.

Budget Optimization Using Data Analytics

Pinpoint where to cut spending without sacrifice. For example, trimming $50 from dining out could shave months off your debt timeline.

Identifying the Best Debt Consolidation and Refinancing Options

We compare rates and terms to find deals that save you money—like consolidating three 18% credit cards into one 8% loan.

You’ll feel confident with a plan that’s clear, personalized, and effective.

5. Real-World Example: A Case Study in Smart Debt Management

Numbers and tech are great, but real stories show what’s possible.

How Data Analytics Helped a Client Reduce Debt by 40%

Meet Sarah, a 38-year-old teacher with $25,000 in debt across credit cards and a car loan. Our analytics revealed she could consolidate at 7% (down from 19%) and redirect $300 monthly from unused subscriptions. In 18 months, her debt dropped to $15,000—a 40% reduction.

Transforming Credit Health and Financial Stability with AI Insights

AI flagged Sarah’s high utilization (80%) as a credit killer. By adjusting payments, her score rose from 620 to 710, unlocking better loan terms.

Key Lessons and Takeaways from the Success Story

Start with data, prioritize high-interest debt, and monitor progress. Sarah’s now saving for retirement while paying off the rest.

Proof that smart strategies work—and they can work for you.

6. Take Control of Your Financial Future

Ready to ditch the debt stress? Here’s how to start and why we’re your partner.

Steps to Begin Your Debt-Free Journey Today

- List all debts (amount, rate, term).

- Assess income and expenses.

- Contact us for a free data-driven analysis.

The Importance of Proactive Credit Health Management

Fixing debt now prevents bigger headaches—like denied mortgages or sky-high rates—later.

How We Can Help You Achieve Financial Freedom

Our team combines analytics, AI, and expertise to guide you. From custom plans to ongoing support, we’re here until you’re debt-free.

Let’s Talk

Schedule your free consultation today and see how much you could save!