Unlocking Insights Through Insurance Data Analysis

Insurance isn’t just about minimizing risk—it’s about gaining a competitive edge. At Qubitstats, we leverage advanced data science and predictive analytics to revolutionize deductible and claims strategies. Whether you’re an insurer, broker, or a self-insured enterprise, mastering the dynamic relationship between deductibles and claims can slash costs, boost customer loyalty, and maximize profitability.

With AI-driven insights and real-time analytics, we don’t just help you manage risk—we help you turn it into opportunity.

Why Deductibles and Claims Matter for Businesses

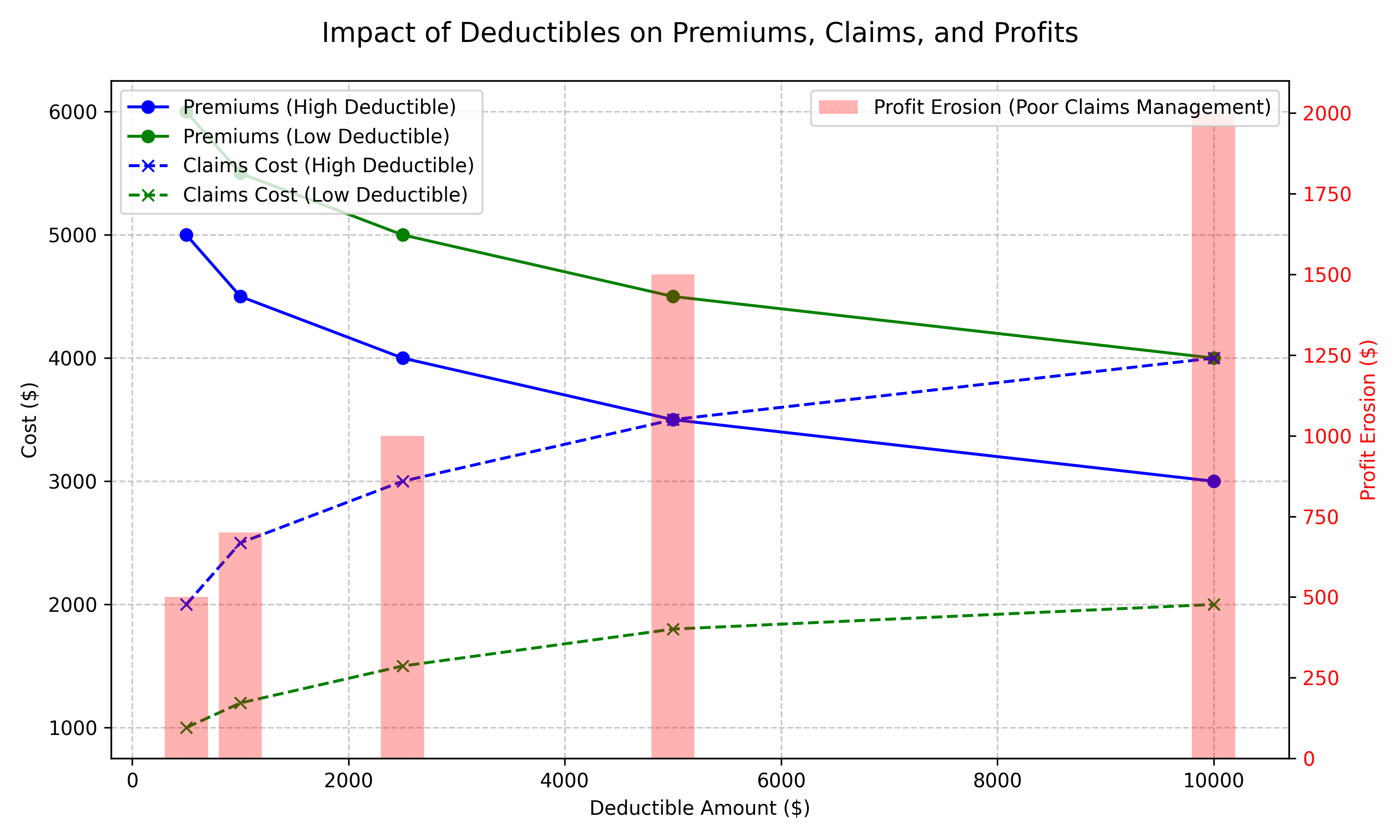

Deductibles and claims aren’t just numbers on a balance sheet—they’re decision points that shape financial outcomes. A poorly managed claims process can erode profits, while an optimized deductible strategy can reduce premiums and enhance cash flow. Our mission? To turn raw insurance data into actionable insights that deliver measurable results.

The Fundamentals of Deductibles and Claims

Let’s break it down to the essentials—because clarity is the first step to mastery.

What Are Insurance Deductibles?

A deductible is the amount a policyholder pays out-of-pocket before insurance kicks in. Think of it as a lever: higher deductibles lower premiums but increase upfront costs, while lower deductibles raise premiums but ease immediate financial burdens. The trick is finding the sweet spot.

How Claims Are Processed: A Data-Driven Perspective

Claims processing isn’t just paperwork—it’s a treasure trove of data. From submission to payout, every step generates insights: claim frequency, severity, processing time, and more. At Qubitstats, we analyze these patterns to streamline operations and cut inefficiencies.

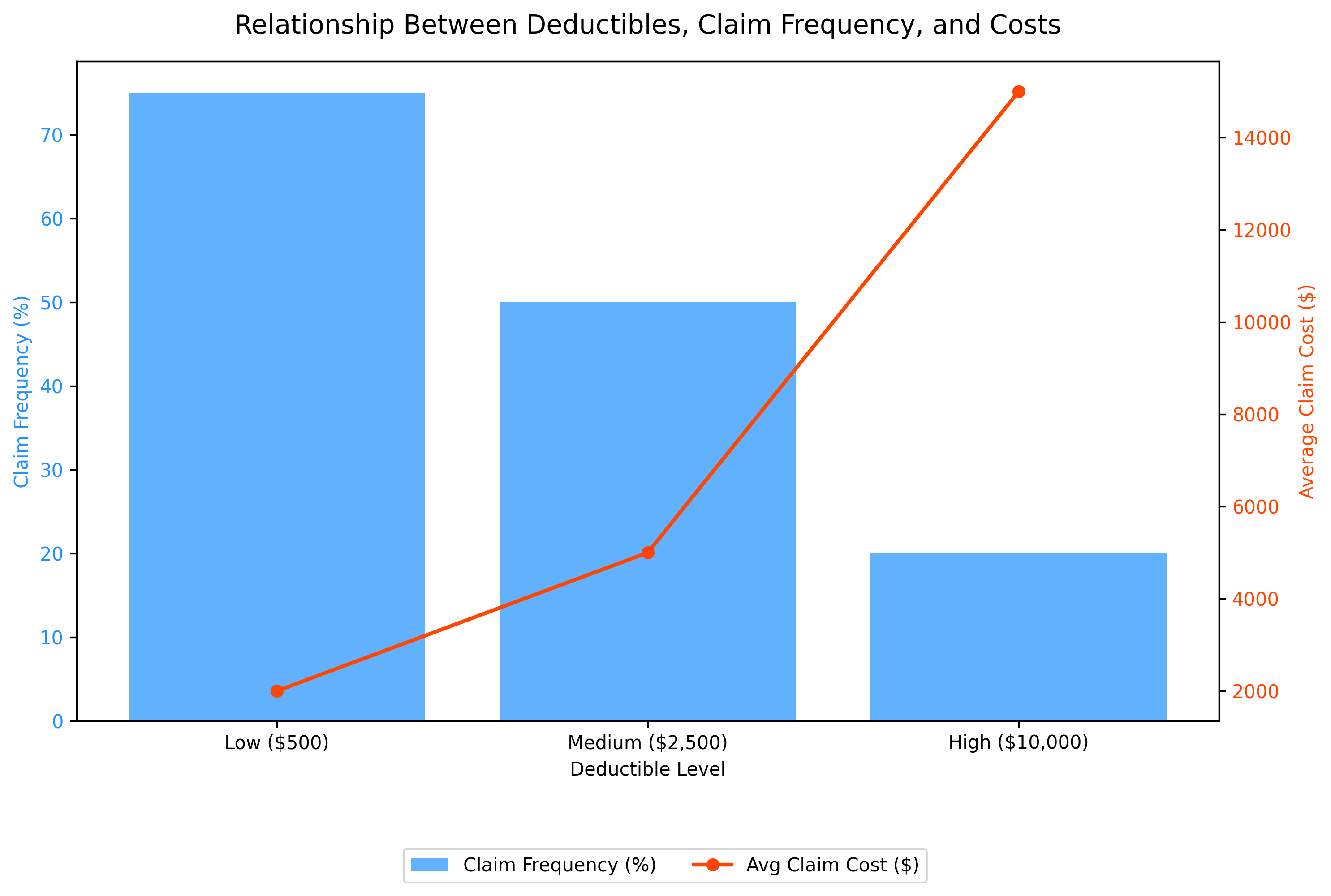

The Relationship Between Deductibles and Claim Costs

Here’s where it gets interesting. Data reveals a clear correlation: higher deductibles often reduce claim frequency (fewer small claims), but when claims do occur, they tend to be larger. Lower deductibles? More frequent claims, but smaller payouts. Check out this chart:

| Deductible Level | Claim Frequency | Average Claim Cost |

|---|---|---|

| Low ($500) | High (75%) | Low ($2,000) |

| Medium ($2,500) | Moderate (50%) | Moderate ($5,000) |

| High ($10,000) | Low (20%) | High ($15,000) |

This balance is where Qubitstats shines—helping you align deductibles with your risk tolerance and financial goals.

How Data Science Optimizes Insurance Decisions

Data isn’t just numbers; it’s a crystal ball. Here’s how we use it to revolutionize insurance.

Predictive Analytics in Claims Management

Imagine knowing which claims are likely to escalate before they do. Our predictive models analyze historical data—weather patterns, customer behavior, claim trends—to forecast outcomes. For example, a retailer reduced claim costs by 15% after we predicted peak seasons for property damage.

Identifying Fraudulent Claims with AI and Machine Learning

Fraud drains profits—up to 10% of claims in some sectors. Our AI tools spot red flags: inconsistent narratives, unusual timing, or outlier costs. One client, a mid-sized insurer, saved $1.2M annually by flagging fraudulent patterns early.

Risk Assessment: Setting the Right Deductibles for Maximum Profitability

Too high, and you’re stuck with cash flow issues. Too low, and premiums eat your margins. We crunch the numbers—loss ratios, industry benchmarks, your unique risk profile—to recommend deductibles that optimize ROI.

Key Challenges in Claims and Deductible Management

Even the best strategies hit roadblocks. Here’s what to watch for—and how we help you overcome them.

Common Pitfalls in Claim Processing

- Delays: Slow approvals frustrate customers and inflate costs.

- Errors: Manual entry leads to miscalculations—costing time and trust.

- Overpayments: Without analytics, you might pay more than necessary.

How Inefficient Deductible Strategies Hurt Business Growth

A one-size-fits-all deductible can backfire. A manufacturing firm we worked with had a $5,000 deductible across the board—fine for equipment, but disastrous for frequent small liability claims. Tailored analytics cut their losses by 22%.

Regulatory Considerations in Insurance Claims

Compliance isn’t optional. From GDPR to state-specific insurance laws, we ensure your data strategies stay within bounds while maximizing efficiency.

Leveraging Data Insights to Drive Business Growth

Transform insights into action—and action into measurable success.

Reducing Claim Costs with Advanced Analytics

Advanced analytics uncovers high-risk patterns, such as frequent claimants or preventable incidents, enabling proactive intervention. For example, a logistics company reduced claims by 18% after we identified and addressed gaps in driver training, saving millions annually.

Boosting Customer Satisfaction Through Data-Driven Decisions

Streamlined claims processing and equitable payouts enhance customer experiences. Our analytics platform reduced average claims processing time by 30% for a leading insurer, resulting in a 12-point increase in their Net Promoter Score (NPS).

Maximizing Profit Margins with Optimized Insurance Strategies

Lower costs and smarter risk management drive higher profitability. By leveraging data-driven insights for deductible adjustments, we’ve empowered clients to boost profit margins by up to 25%, ensuring sustainable growth.

Real-World Case Study: How Data Science Transformed an Insurance Firm

The Challenge

A regional insurer faced rising claim costs, slow processing, and frustrated policyholders. Their one-size-fits-all $1,000 deductible wasn’t cutting it.

The Transformation Process

- Step 1: Analyzed 5 years of claims data to map frequency and severity.

- Step 2: Built a predictive model to flag high-risk claims early.

- Step 3: Adjusted deductibles—$500 for low-risk clients, $5,000 for high-risk—based on risk profiles.

The Results

- Cost Savings: Reduced claim payouts by 20% ($3.5M annually).

- Efficiency: Cut processing time from 14 days to 8 days.

- Growth: Customer retention rose 15%, driving new business.

Why Partner with Qubitstats for Insurance Data Analysis?

Our Expertise in Insurance Analytics

With decades of combined experience, our team blends data science with insurance know-how. We don’t just crunch numbers—we solve problems.

Tailored Solutions for Your Business Needs

No cookie-cutter fixes here. Whether you’re a small broker or a global insurer, we craft strategies that fit your goals—backed by data, not guesswork.

Proven Results: How We Help Clients Maximize Their Insurance ROI

- Case 1: A retailer boosted margins by 18% with optimized deductibles.

- Case 2: An insurer cut fraud losses by 30% with AI-driven detection.

- Case 3: A self-insured firm saved $2M through predictive risk modeling.

Take Action: Optimize Your Insurance Strategies Today!

Ready to turn data into dollars? Here’s how to start:

Book a Free Consultation with Our Experts

Let’s discuss your challenges and goals—no strings attached.

Get a Customized Data Analysis Report

See your insurance data in a new light with a tailored insights report.

Stay Ahead of the Competition

With Qubitstats, you’re not just keeping up—you’re leading the pack.

Ready to Transform Your Insurance Game?

Contact us today to schedule your free consultation. Let’s unlock the insights hiding in your data—and turn them into results you can bank on.