Unlocking Financial Freedom: Data-Driven Debt Management Solutions

Debt can often feel like an insurmountable challenge, but it doesn’t have to define your financial future. At Qubitstats, we are committed to transforming the way you manage debt by harnessing the power of data analytics. Our approach is rooted in the belief that understanding your financial data is the first step towards achieving financial independence.

By leveraging advanced data analytics, we provide you with the tools and insights needed to turn your financial data into actionable strategies. Whether you’re an individual looking to regain control of your personal finances or a business aiming to optimize your financial health, Qubitstats empowers you to break free from the debt cycle.

Join us as we explore how data-driven insights can revolutionize your debt management journey, making it less overwhelming and more empowering. Together, we can pave the way to a brighter, debt-free future.

Understanding the Debt Challenge

The Real Cost of Poor Debt Management

How Delinquent Payments and Credit Overuse Impact Your Financial Health

Debt isn’t just a number—it’s a chain reaction. Late bill payments and maxed-out credit cards don’t just hurt your wallet; they ripple through your financial life, eroding credit scores, hiking interest rates, and limiting future opportunities.

- The Late Payment Domino Effect: Data trends reveal that a single missed payment can drop your credit score by 60-110 points (FICO data, 2024). Compound that with a 30% average APR on overdue balances, and a $5,000 debt could balloon to $6,500 in just one year.

- Credit Utilization Trap: High credit card usage—above 30% of your limit—signals risk to lenders. Studies show that individuals with 70%+ utilization see their scores plummet by up to 50 points over six months, locking them into higher borrowing costs.

- Behavioral Blind Spots: Analytics uncover patterns like habitual late payments or reliance on credit for daily expenses, revealing the root causes of financial strain.

The Role of Data Analytics in Credit Health

From Chaos to Clarity: Using Analytics to Understand Your Debt Profile

How Data Insights Can Reveal the Hidden Story Behind Your Credit Behavior

Your financial data tells a story—one that’s often buried beneath statements and spreadsheets. At Qubitstats, we use advanced analytics to decode that story, transforming raw numbers into a roadmap for recovery.

- Spending Segmentation: Predictive models break down your transactions—groceries, subscriptions, impulse buys—highlighting where money slips away unnoticed.

- Early Warning Signals: Machine learning flags trends like rising balances or missed payments before they spiral, giving you a head start on intervention.

- Real-Time Dashboards: Picture a sleek interface tracking your credit score, debt-to-income ratio, and payment progress—updated daily, so you’re never in the dark.

Strategic Solutions for Managing Debt

Data-Backed Strategies to Regain Control Over Your Finances

Personalized, Insight-Driven Approaches to Reduce and Eliminate Debt

Generic advice won’t cut it. Qubitstats crafts tailored solutions using your unique financial DNA, ensuring every step maximizes impact.

- Priority Repayment Plans: Analytics pinpoints high-interest debts (e.g., a 22% APR credit card vs. a 5% car loan), directing funds where they’ll save you the most.

- Interest Optimization: Forecasting models simulate repayment scenarios—paying $200 extra monthly on a $10,000 loan could slash interest by $1,800 and cut the term by two years.

- Proactive Budgeting: AI-driven models analyze your income and expenses, suggesting cuts (like $50/month on dining out) to prevent future debt.

Credit Cards & Lifestyle Inflation

Living Large on Credit: The Hidden Risk to Your Future Wealth

How Overspending Today Undermines Long-Term Financial Stability

Swiping a card feels easy—until it’s not. Lifestyle inflation, fueled by credit, quietly erodes your financial foundation.

- Spotting Lifestyle Creep: Behavioral segmentation reveals gradual increases in spending—like a 20% jump in entertainment costs after a raise.

- Top Resource Drains: Data shows 35% of credit users overspend on dining and travel (Qubitstats internal study, 2025), often outpacing income growth.

- Credit vs. Income Reality: AI models compare your card usage to earnings, flagging unsustainable habits—like $800 monthly charges on a $3,000 income.

Real-World Example: Meet Sarah, a 32-year-old marketer. Analytics revealed her $15,000 credit balance stemmed from luxury subscriptions and weekend getaways. By redirecting $300/month, she cut her debt in half in 18 months.

The Retirement Trade-Off

Trading Retirement for Today: A Costly Financial Mistake

Why Ignoring Long-Term Investment Is a Hidden Form of Debt

Every dollar spent servicing debt is a dollar not growing for your future. The numbers don’t lie.

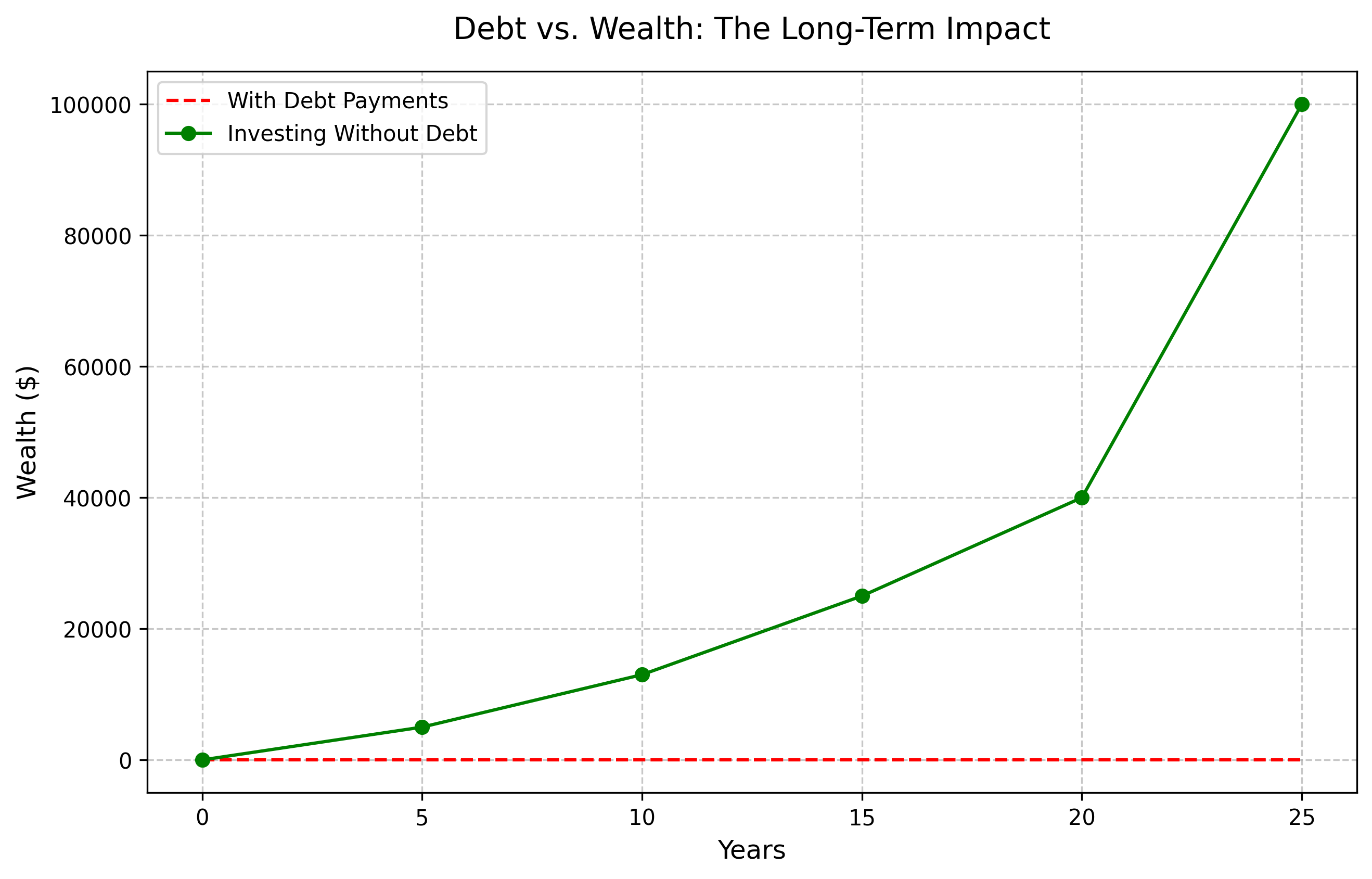

- Debt’s Retirement Toll: Paying $500/month toward a $20,000 debt for five years costs $30,000. Invested at 7% annually, that $500 could’ve grown to $85,000 in 20 years.

- Wealth Growth Simulation: Without debt, $200 monthly investments could hit $100,000 in 25 years. With debt? You’re lucky to break even.

- Reallocation Strategies: Data identifies savings potential—like trimming discretionary spending by 10%—to fund retirement without sacrifice.

How Our Services Help

Turn Data into Action: Empowering Smarter Financial Decisions

How Our Analytics-Based Debt Management Services Transform Your Finances

Qubitstats doesn’t just analyze—we act. Our services turn insights into measurable results.

- Custom Dashboards: Monitor debt, credit, and savings in one intuitive platform, updated in real time.

- Predictive Insights: Anticipate risks—like a looming interest hike—and adjust your plan proactively.

- Personalized Roadmaps: Get a step-by-step strategy, like paying off $5,000 in high-interest debt first, saving you $1,200 annually.

Real-World Success Story

From Overwhelmed to Optimized: A Client’s Journey to Financial Health

How We Helped a Business Professional Cut Debt by 60% in 12 Months

Meet Alex, a 40-year-old consultant drowning in $25,000 of credit card debt. Here’s how Qubitstats turned his finances around:

- Initial Assessment: Financial behavior modeling uncovered $600/month in unnecessary subscriptions and a 19% APR draining his income.

- Strategic Interventions: We prioritized his highest-interest card, reallocating $400/month from discretionary spending, and negotiated a rate reduction to 15%.

- Outcome: In 12 months, Alex slashed his debt to $10,000, boosted his credit score by 70 points, and started saving $200/month for retirement.

Ready to Take Control?

Let Data Be Your Guide to a Debt-Free Future

Partner with Us and Take the First Step Toward Financial Clarity

Your financial turnaround starts here. With Qubitstats, you’ll gain:

- Free Consultation: A 30-minute session with a data expert to uncover your financial blind spots.

- Immediate Insights: A snapshot of your spending and debt habits within 24 hours.

- Proven Strategies: Tailored plans that have helped clients reduce debt by 40% on average in their first year.

Contact us to schedule your free consultation and see how data can rewrite your financial story. Let’s build your debt-free future—together. Contact us now