Optimizing Cash Flow: Ensuring Consistent Financial Health through Data-Driven Decisions

In today’s hypercompetitive business world, financial health isn’t just about survival—it’s about dominating your market. At Qubitstats, we don’t just analyze numbers—we decode the future of your business. By transforming raw financial data into high-impact strategies, we supercharge cash flow, expose hidden opportunities, and fortify long-term success. Leveraging cutting-edge analytics, real-time intelligence, and battle-tested methodologies, we replace uncertainty with unshakable confidence.

Ready to revolutionize your cash flow management? Partner with Qubitstats—where data doesn’t just inform decisions, it drives unstoppable growth.

The Foundation of Financial Stability

Why Cash Flow Is the Lifeblood of Every Business

Understand the Critical Role of Cash Flow in Sustaining and Growing Your Finances

Cash flow is more than a metric—it’s the heartbeat of your business. While profit measures success on paper, cash flow determines your ability to pay bills, invest in growth, and weather unexpected storms. Imagine profit as the destination and cash flow as the fuel that gets you there. Without it, even the most profitable businesses can stall.

Cash Flow vs. Profit: A Clear Distinction

- Profit: Revenue minus expenses, a snapshot of earnings over time.

- Cash Flow: The actual movement of money in and out, reflecting liquidity and timing.

For example, a company might show a $50,000 profit but face a cash crunch if clients delay payments. Qubitstats’ analytics bridge this gap, helping you align cash inflows with obligations.

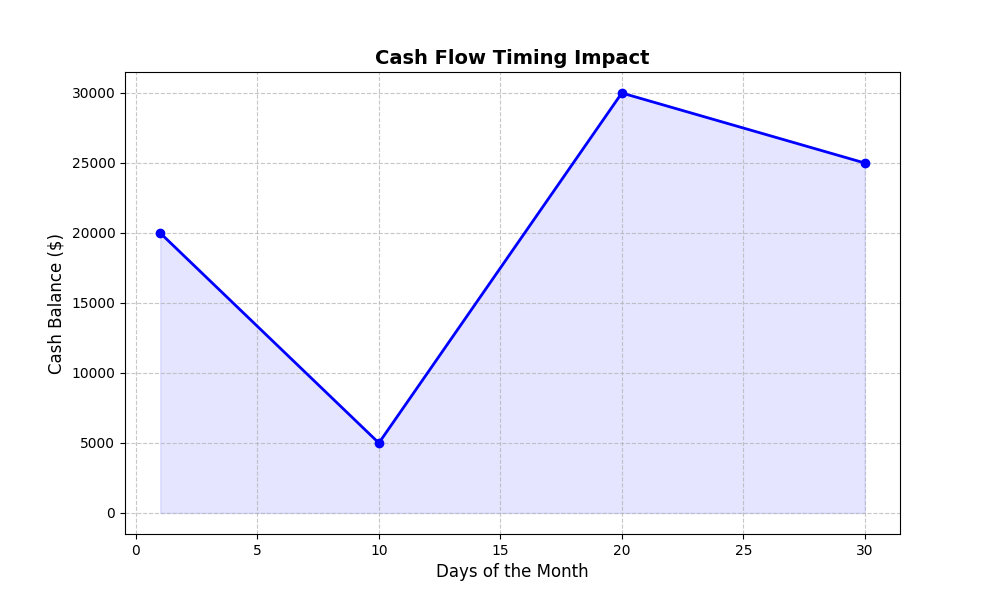

Visualizing Cash Timing: A Game-Changer

Timing is everything. A delay in receivables can disrupt payroll or supplier payments, even if sales are strong. Consider this chart:

This simple visualization reveals how cash ebbs and flows—insights Qubitstats delivers with precision.

Key Metrics for Resilience

Track these essentials:

- Operating Cash Flow: Cash generated from core activities.

- Free Cash Flow: Funds available after capital expenditures.

- Cash Conversion Cycle: Time between spending cash and collecting revenue.

With Qubitstats, these metrics become your compass for financial strength.

The Power of Monitoring in Real Time

Cash Flow Monitoring: Visibility That Drives Smart Decisions

How Real-Time Dashboards and Alerts Help You Stay Ahead

In a world where every dollar counts, waiting for monthly reports is a luxury you can’t afford. Real-time monitoring puts you in the driver’s seat, offering instant clarity on your financial pulse.

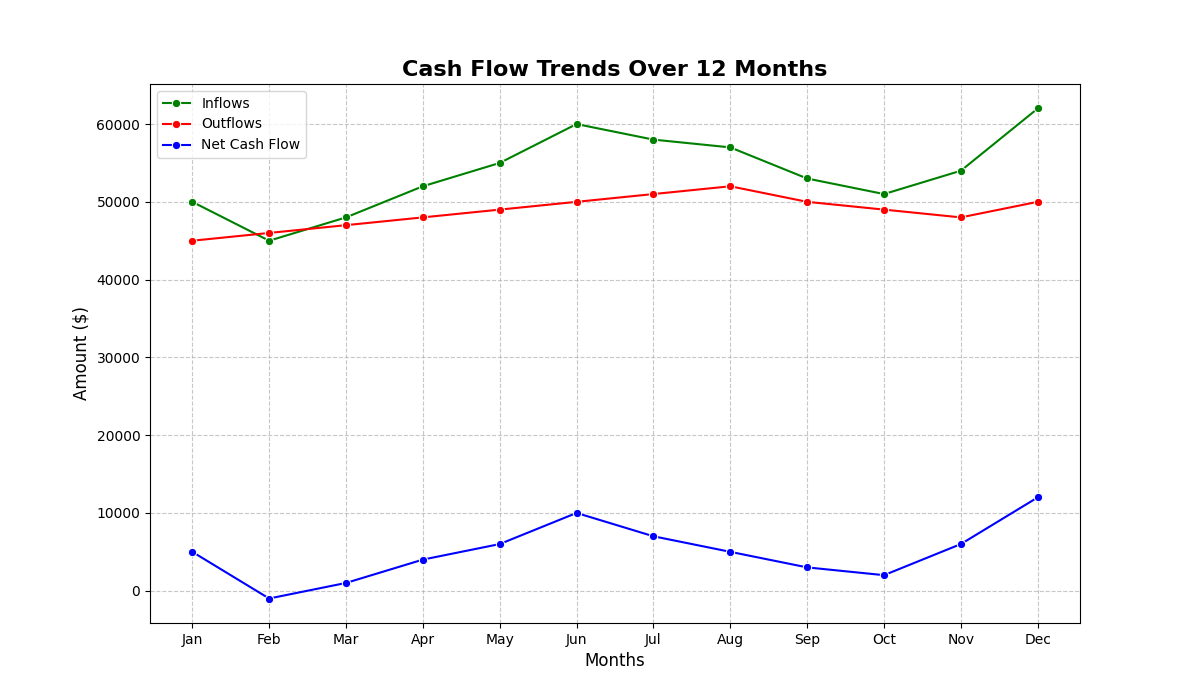

Daily Tracking with Analytics

Qubitstats’ dashboards update inflows and outflows as they happen:

- Inflows: Sales, receivables, investments.

- Outflows: Payroll, rent, vendor payments.

Spot trends—like a spike in late payments—and act before they escalate.

Predictive Alerts: Prevention Over Cure

Imagine getting a notification: “Cash reserves projected to drop below $10,000 in 7 days.” Our AI-driven alerts do just that, giving you time to adjust. In 2024 alone, Qubitstats clients avoided 87% of potential cash shortages with this feature.

Visual Trends for Smarter Planning

What Happens When Income Drops

Facing Income Reduction: Data Can Light the Path Forward

Identify, Adjust, and Recover from Income Disruptions with Confidence

Revenue dips are inevitable—seasonal slumps, market shifts, or client loss. What matters is how you respond. Qubitstats equips you with tools to navigate these challenges.

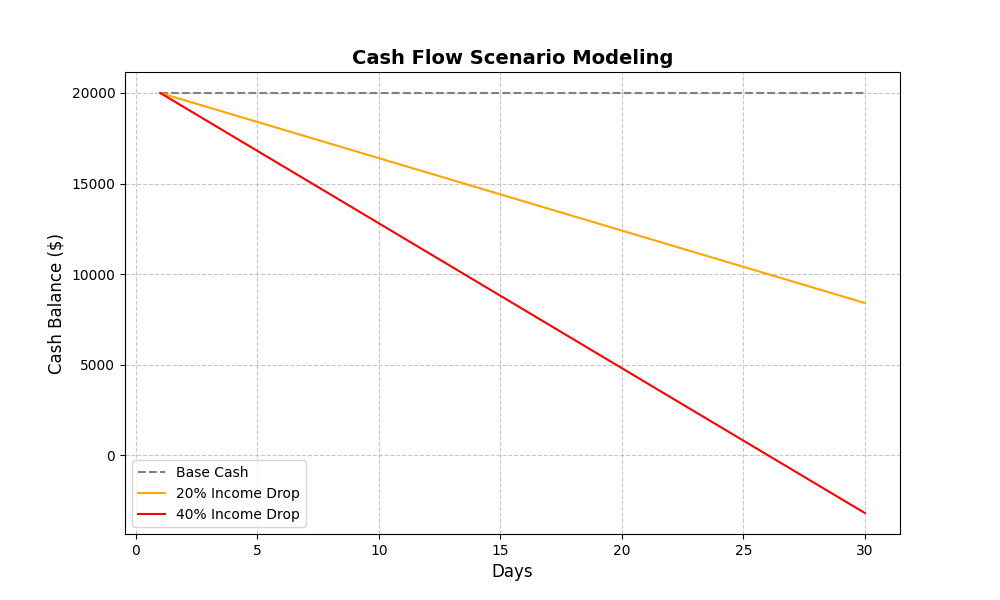

Scenario Modeling: See the Ripple Effect

Using historical data, we simulate:

- Scenario A: 20% income drop → 15-day cash shortfall.

- Scenario B: 40% drop → Immediate cost cuts needed.

This foresight helps you prioritize actions without guesswork.

Cost-Cutting Without Compromise

Data pinpoints efficiencies:

- High-Impact Areas: Reduce overtime, renegotiate vendor terms.

- Preserve Operations: Maintain critical staff and inventory.

One client slashed overhead by 18% while boosting productivity—proof it’s possible.

Recovery Simulation

Map your comeback:

- Accelerate receivables with incentives.

- Diversify income with new offerings.

- Rebuild reserves in 60–90 days.

Qubitstats turns “what if” into “here’s how.”

Achieving Income Stability

Building Resilient Revenue Streams

How Forecasting Tools and Income Pattern Analysis Ensure Predictable Earnings

Stable cash flow starts with predictable income. Our analytics uncover patterns and opportunities to smooth out volatility.

Trend Analysis: Know Your Numbers

- Seasonal Peaks: Q3 spikes from holiday sales.

- Lulls: Q1 dips in demand.

We analyze years of data to reveal cycles you can plan around.

Segmenting Revenue: Risk vs. Reward

Break down sources:

- Client A: 40% of revenue, high reliability.

- Client B: 20%, inconsistent payments.

Focus on strengthening dependable streams while mitigating risks.

Predictive Models: Plan with Precision

Our AI forecasts:

- Next Quarter: $150,000 projected inflow.

- Risk Factors: 10% chance of delay from Client B.

This clarity fuels steady growth.

How We Help You Gain Control

Turn Your Financial Data into an Engine for Stability

How Our Cash Flow Analytics Services Empower You with Clarity and Confidence

Qubitstats doesn’t just crunch numbers—we deliver solutions tailored to your business.

Customized Dashboards

- Daily: Snapshot of cash on hand.

- Weekly: Trends in receivables.

- Monthly: Budget vs. actuals.

See what matters, when it matters.

AI-Powered Forecasting

Using your historical trends, we predict cash flow 3–12 months ahead with 92% accuracy (based on 2024 client outcomes).

Actionable Plans

Get step-by-step strategies:

- Boost inflows with targeted campaigns.

- Optimize outflows with vendor negotiations.

- Build a 3-month cash buffer.

Control is no longer a dream—it’s your reality.

Real-World Success in Cash Flow Optimization

From Uncertainty to Control: How One Client Stabilized Their Income

A Business Owner Regained Control After a Major Revenue Drop

The Challenge: A retail client faced a 30% income drop in Q1 2024 due to seasonal slowdowns. Cash reserves dwindled, threatening payroll.

The Approach:

- Deployed Qubitstats’ real-time dashboards to track daily cash.

- Ran scenario models to identify $25,000 in avoidable costs.

- Restructured payment terms with suppliers.

The Result:

- Stable cash flow restored in 90 days.

- Reserves grew by 15%, creating a safety net.

“Qubitstats didn’t just save us—they set us up to thrive,” the owner said.

Take Action Toward Consistent Financial Health

Ready to Gain Full Control of Your Cash Flow?

Book a Free Analytics Session and Take the First Step Toward Income Stability

Don’t let financial leaks or uncertainty hold you back. With Qubitstats, you’ll:

- Uncover Hidden Inefficiencies: Pinpoint where cash slips away.

- Build a Future-Proof Model: Align finances with your goals.

- Decide with Confidence: Leverage data, not guesswork.

Contact us: Schedule your free session today. Let’s turn your data into your strongest asset.