In a world drowning in numbers, those who can transform data into financial wisdom hold the key to prosperity. When every transaction tells a story, are you listening?

The Importance of Data in Financial Planning

In today’s digital economy, every financial decision leaves a digital footprint. From morning coffee purchases to retirement investments, data points accumulate, creating a comprehensive picture of our financial lives. This wealth of information represents an unprecedented opportunity to transform financial planning from an intuition-based practice to a precise, data-driven science.

Financial planning powered by data insights allows individuals and businesses to move beyond traditional budgeting constraints and develop strategies based on actual behavior rather than assumptions. When properly analyzed, this data reveals patterns, highlights inefficiencies, and identifies opportunities that would otherwise remain hidden beneath the surface of conventional financial statements.

Understanding Budgeting Basics

What is Budgeting?

At its core, budgeting is the process of creating a plan to spend your money. This spending plan helps you determine in advance whether you will have enough money to do the things you need to do or would like to do. Traditionally, budgeting has been viewed as a restrictive practice—a financial diet of sorts—but modern approaches frame it as a pathway to financial freedom rather than constraint.

Effective budgeting doesn’t just allocate resources; it aligns spending with values. When your budget reflects what truly matters to you, financial decisions become clearer and more purposeful. Data-driven budgeting enhances this alignment by revealing the sometimes stark contrast between stated priorities and actual spending patterns.

Key Components of a Budget

A comprehensive budget contains several essential elements:

- Income tracking: Documenting all sources of revenue with accuracy and consistency

- Expense categorization: Organizing spending into meaningful categories

- Time horizons: Distinguishing between short-term and long-term financial objectives

- Flexibility mechanisms: Building in adjustments for unexpected circumstances

- Measurement tools: Establishing metrics to evaluate budget performance

The effectiveness of these components multiplies when supported by robust data collection and analysis. Rather than relying on estimates or assumptions, data-driven budgets capture actual financial behaviors, providing a foundation for realistic planning.

Data-Driven Budgeting

Leveraging Data for Effective Budgeting

Data-driven budgeting represents a paradigm shift from traditional approaches. Instead of creating budgets based primarily on intuition or past patterns, this method incorporates comprehensive analysis of spending behaviors, income fluctuations, and external economic factors.

The process begins with collection of granular financial data—transaction records, account statements, investment performance, and even economic indicators. This raw information is then transformed through analysis into actionable insights that reveal:

- Spending patterns previously invisible in aggregate numbers

- Seasonal variations in both income and expenses

- Correlation between specific financial behaviors and outcomes

- Early warning indicators of potential financial issues

- Optimization opportunities within existing resource allocation

These insights allow for budgets that are not merely prescriptive but adaptive and predictive, evolving as new data becomes available.

Tools and Techniques for Data Analysis

Modern financial planning leverages sophisticated analytical techniques:

- Descriptive analytics: Summarizing historical financial data to understand past patterns

- Diagnostic analytics: Determining why certain financial outcomes occurred

- Predictive analytics: Forecasting future financial scenarios based on historical trends

- Prescriptive analytics: Recommending specific actions to improve financial outcomes

These analytical approaches are supported by an ecosystem of tools ranging from simple spreadsheets to advanced financial software with machine learning capabilities. The democratization of these tools has made sophisticated financial analysis accessible to individuals and small businesses, not just large corporations with dedicated financial departments.

Financial Planning with Data Insights

Setting Financial Goals

Data-informed goal setting represents a significant improvement over arbitrary targets. When financial objectives are calibrated against historical performance data, they become both ambitious and achievable. This approach considers:

- Personal spending velocity across different categories

- Realistic saving capacity based on income stability

- Investment performance benchmarked against relevant indices

- Debt reduction potential modeled with varying payment strategies

- Emergency fund requirements calculated from actual past emergencies

The resulting goals have built-in accountability measures since progress can be tracked against baseline data, creating a continuous feedback loop for financial improvement.

Using Data to Track Progress

Progress tracking becomes exponentially more effective when powered by comprehensive data. Rather than simply noting whether a goal has been achieved, data-driven tracking can:

- Visualize progress trajectories over various time horizons

- Identify micro-trends that might indicate future challenges

- Highlight correlations between specific behaviors and outcomes

- Automatically adjust projections based on actual performance

- Provide contextualized feedback rather than binary success/failure metrics

This nuanced approach to progress monitoring transforms financial planning from a periodic review activity to an ongoing optimization process.

Common Budgeting Mistakes

Avoiding Pitfalls with Data-Driven Decisions

Data insights help identify and prevent common budgeting errors:

- Underestimating variable expenses: Analysis of historical spending reveals true cost ranges

- Category blindness: Granular data exposes spending categories previously overlooked

- Recency bias: Longitudinal data provides perspective beyond recent financial events

- Wishful projections: Historical performance data grounds forecasts in reality

- False equivalence: Comparative analytics distinguishes between similar-seeming financial options

These data-driven corrections don’t just improve budget accuracy—they fundamentally change how financial decisions are evaluated and made.

Case Studies: Learning from Others

Anonymized financial data from millions of consumers has created unprecedented opportunities to learn from collective experience:

Case Study 1: The Coffee Factor

Analysis of transaction data from 50,000 consumers revealed that those who gradually reduced discretionary spending (like daily premium coffee purchases) were 67% more likely to maintain their budgets long-term than those who attempted to eliminate categories entirely. This finding contradicts conventional financial advice advocating for elimination of “luxury” purchases.

Case Study 2: The Emergency Fund Threshold

Data analysis of household financial resilience during economic downturns identified that emergency funds equal to 3.7 months of essential expenses (rather than the often-cited 6 months of total expenses) provided sufficient stability for 92% of households. This insight allows for more efficient capital allocation for many families.

Advanced Financial Planning Strategies

Investment Planning with Data

Investment decisions benefit tremendously from data-driven approaches:

- Portfolio optimization: Using historical performance data to calibrate asset allocation

- Risk profiling: Quantifying risk tolerance through behavioral data rather than self-reporting

- Fee impact analysis: Visualizing the long-term impact of seemingly small expense ratios

- Tax-efficiency modeling: Identifying optimal account structures based on actual tax impacts

- Retirement scenario planning: Testing multiple withdrawal strategies against market simulations

These strategies move beyond simplistic investment rules to create personalized approaches based on individual financial data profiles.

Risk Management and Data Analytics

Comprehensive financial planning includes proactive risk management enhanced by data:

- Probability-weighted risk assessment: Using historical data to quantify potential financial threats

- Insurance optimization: Determining appropriate coverage levels based on actual risk exposure

- Stress testing: Modeling financial resilience under various adverse scenarios

- Correlation analysis: Identifying unexpected relationships between seemingly unrelated risks

- Early warning systems: Establishing data triggers that signal emerging financial vulnerabilities

This systematic approach transforms risk management from a vague concern to a quantifiable component of financial planning.

Technology and Financial Planning

Software Solutions for Budgeting

The technological landscape for financial planning continues to evolve rapidly:

- Automated transaction categorization: Systems that learn individual spending patterns

- Real-time budget notifications: Immediate feedback on spending decisions

- API-enabled financial aggregation: Holistic view across all financial institutions

- Collaborative planning tools: Platforms that facilitate financial communication between partners

- Subscription tracking: Specialized tools to manage recurring payments in the subscription economy

These solutions reduce the friction in financial management, making consistent budgeting more accessible.

The Role of AI and Machine Learning

Artificial intelligence is transforming financial planning through:

- Predictive cash flow management: Anticipating income and expense fluctuations

- Anomaly detection: Identifying unusual transactions that may indicate fraud or billing errors

- Personalized financial advice: Generating recommendations based on individual financial patterns

- Natural language interfaces: Allowing intuitive interaction with complex financial data

- Continuous optimization: Algorithms that constantly refine financial recommendations

As these technologies mature, they increasingly supplement human judgment rather than simply automating mechanical aspects of financial management.

Real-World Applications

Personal Finance: A Data-Driven Approach

Individual financial management benefits from data science in numerous ways:

- Behavioral spending analysis: Understanding emotional and environmental spending triggers

- Life stage financial benchmarking: Comparing financial health to relevant peer groups

- Financial decision modeling: Visualizing long-term impacts of major life choices

- Automated savings optimization: Algorithms that identify optimal saving opportunities

- Debt reduction strategizing: Data-based approaches to accelerating debt elimination

These applications transform personal finance from an exercise in willpower to a scientific approach based on understanding individual financial behavior.

Business Finance: Data Insights for Success

Organizations leverage financial data for strategic advantage through:

- Cash flow prediction: Advanced modeling of revenue and expense timing

- Working capital optimization: Data-driven management of operational liquidity

- Customer profitability analysis: Granular understanding of relationship economics

- Investment prioritization: ROI forecasting based on historical performance data

- Scenario planning: Financial impact analysis of various strategic alternatives

This analytical approach to business finance creates competitive advantage beyond traditional accounting practices.

Final thoughts

The Future of Budgeting and Financial Planning

The intersection of finance and data science continues to create new possibilities:

- Integration of alternative data sources into financial planning

- Democratization of sophisticated financial analysis tools

- Increasing personalization of financial recommendations

- Evolution from descriptive to prescriptive financial guidance

- Seamless integration of financial planning into daily decision-making

These developments suggest a future where financial planning becomes more accessible, effective, and integrated into everyday life.

Embracing Data for Long-Term Success

The financial landscape increasingly rewards those who effectively leverage data in their planning processes. By embracing a data-driven approach to budgeting and financial planning, individuals and organizations can:

- Make decisions based on evidence rather than emotion

- Identify opportunities hidden within complex financial situations

- Adapt quickly to changing economic circumstances

- Measure progress with precision and context

- Build financial strategies aligned with their unique patterns and preferences

In a world of financial complexity, data provides clarity—transforming uncertainty into opportunity for those willing to listen to the stories their financial data tells.

This article was developed using advanced financial planning methodologies and data science principles. The recommendations provided should be considered within the context of individual financial circumstances and objectives.

How Our Services Empower You?

Unlock Financial Control with Analytics-Powered Planning

Qubitstats isn’t just software—it’s your financial partner. Our tailored dashboards deliver instant clarity: see your net worth, track budgets, and monitor savings goals in one glance. Strategic planning, rooted in predictive insights, aligns your finances with your dreams—whether it’s debt freedom or a dream vacation.

Client Testimonial Snippet: “Qubitstats showed me where my money was disappearing and gave me a plan I could actually follow. I’m finally in control.” — Lisa M., Marketing Manager

Real-time analytics mean better decisions, every day. Stability and growth are no longer aspirations—they’re results.

Real Client Success

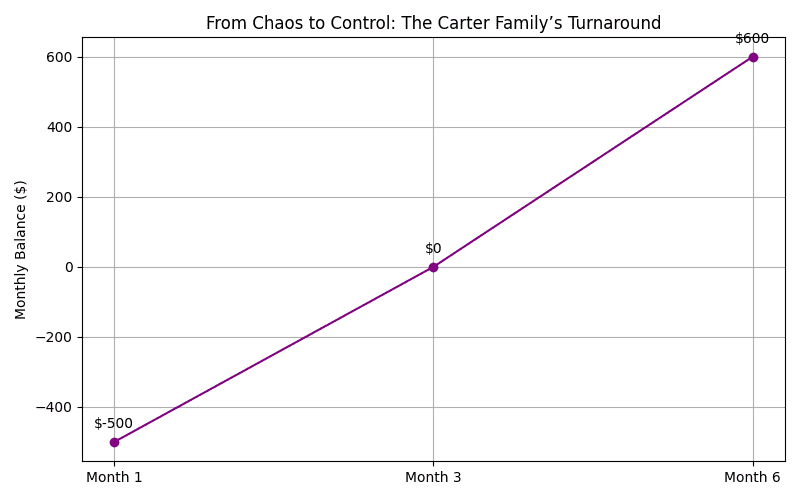

From Chaos to Control: A Professional’s Financial Turnaround

How Our Services Helped a Family Slash Overspending by 40%

The Challenge: The Carter family—dual-income, no emergency fund—spent $6,500 monthly against a $6,000 income, dipping into credit cards. Chaos reigned.

The Solution: Qubitstats deployed AI-backed budget planning and real-time spend tracking. We flagged $1,200 in discretionary overspending (dining, subscriptions) and set automated limits.

The Results: Within six months, overspending dropped 40% to $3,900. They built a $3,600 emergency fund and boosted savings by 30%, all while enjoying guilt-free date nights.

Visual Timeline: A progress graphic—Month 1: $500 deficit; Month 3: breakeven; Month 6: $600 surplus—shows their journey from chaos to control.

Your turnaround story starts with data.

Take the First Step to Financial Confidence

Get Started with a Free Financial Analytics Consultation Today

Why wait? In one free session, Qubitstats uncovers your financial blind spots, reveals tailored budgeting strategies, and sets you on a path to success. Our experts transform your data into a clear, actionable plan—delivered with the warmth of a partner who cares.

Contact us: “Claim Your Free Consultation Now” — Immediate insights, zero risk.

Partner with Qubitstats, and turn financial stress into financial strength. Your stable future begins today.