In an industry where risks and competition are constantly shifting, data isn’t just power—it’s profit. At Qubitstats, we turn complex data into game-changing insights, helping auto insurers optimize pricing, mitigate risks, and supercharge profitability—all while delivering exceptional customer experiences.

How Predictive Analytics Optimizes Risk & Pricing

Unlocking Competitive Advantage Through Data-Driven Decisions

The future of auto insurance belongs to those who predict, adapt, and outperform. By harnessing AI-powered predictive analytics, insurers can anticipate risks with precision, personalize pricing dynamically, and stay ahead of market trends.

Ready to transform data into your strongest asset? Let’s dive into how Qubitstats can help you lead the race—with smarter insights and unbeatable results.

The Power of Predictive Analytics in Auto Insurance

The Evolution of Pricing: From Guesswork to Precision

Once reliant on static tables and broad assumptions, auto insurance pricing has undergone a seismic shift. Traditional models—think age brackets and basic claim histories—pale in comparison to today’s AI-driven strategies. Predictive analytics harnesses vast datasets and cutting-edge algorithms to deliver precision pricing that reflects real-world risks and customer behaviors.

Why Predictive Analytics? Precision, Profitability, and People

- Precision: Pinpoint risks with granular accuracy, ensuring premiums match exposure.

- Profitability: Minimize losses and maximize margins with data-backed decisions.

- Customer Satisfaction: Offer fair, personalized pricing that builds trust and loyalty.

Imagine an insurer slashing claim costs by 20% while retaining 15% more policyholders—all because they traded outdated methods for predictive power. That’s the Qubitstats difference.

Key Factors Shaping Auto Insurance Premiums

Predictive analytics doesn’t just crunch numbers—it uncovers the why behind the data. Here’s what drives premiums and how we turn these factors into opportunities:

Driver Profile and Behavior

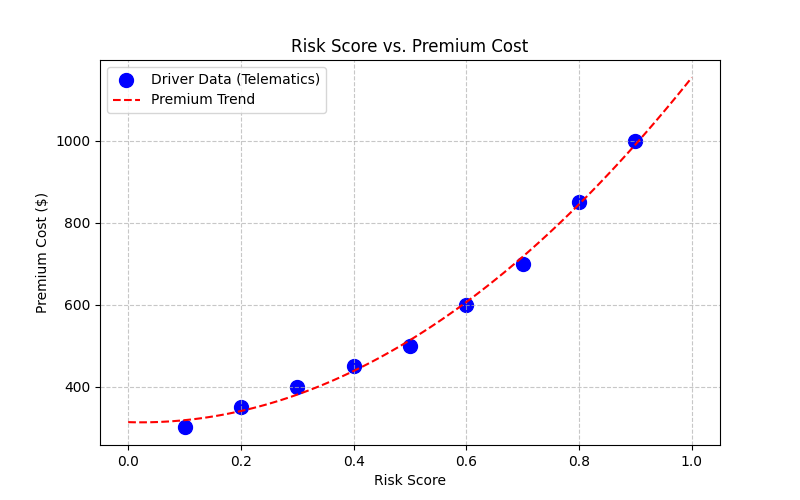

Historical data (e.g., past accidents) meets real-time insights (e.g., telematics tracking braking patterns). A cautious driver in a high-risk area might pay less than a reckless one in a safe zone—analytics makes it possible.

Vehicle Characteristics

A car’s make, model, and safety features matter. A Tesla with autopilot could lower premiums due to reduced crash likelihood, while an older model without airbags might spike risk scores.

Location & Risk Assessment

Geospatial analytics maps everything from urban traffic density to regional weather risks. A driver in stormy Miami faces different odds than one in sunny Boise—and our models reflect that.

Claim History & Fraud Detection

AI sifts through claims to spot patterns. A policyholder with frequent small claims might signal fraud—or just bad luck. We help you tell the difference.

Market Trends & Economic Factors

Inflation hikes repair costs, while a booming economy might increase car ownership. Our models adapt to these shifts, keeping your pricing competitive.

Predictive Analytics: How It Works in Auto Insurance Pricing

Data Collection & Integration

We fuse customer profiles, vehicle specs, telematics feeds, and market trends into a unified data ecosystem—your foundation for smarter decisions.

Machine Learning Models for Risk Prediction

From linear regression to deep neural networks, our algorithms evolve with your data. They predict everything from crash likelihood to claim severity, refining accuracy over time.

Telematics & IoT: The Rise of Usage-Based Insurance (UBI)

Real-time data from connected cars—speed, mileage, even nighttime driving—powers UBI. A low-mileage driver could save 30% on premiums, while you gain insights to refine risk pools.

Anomaly Detection & Fraud Prevention

AI flags suspicious claims—like a fender bender reported in two states simultaneously—saving millions in payouts.

How Qubitstats Drives Business Growth for Insurers

Our data science solutions don’t just analyze—they transform. Here’s how we deliver results:

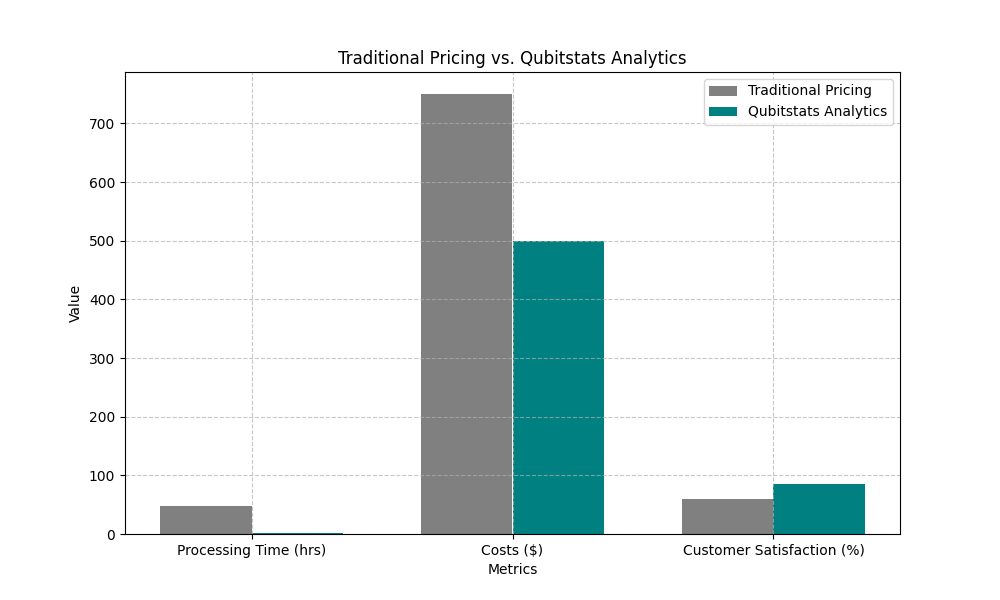

- Optimized Risk & Pricing: Cut losses by 15-25% with models that predict risks before they materialize.

- Customer Segmentation: Tailor policies to micro-segments—think “urban commuters” vs. “weekend road trippers”—boosting retention by up to 20%.

- Real-Time Decisions: Slash underwriting times from days to minutes with automated, accurate assessments.

- Fraud Reduction: Our AI detects 30% more fraudulent claims than traditional methods, safeguarding your bottom line.

Real-World Success: A 30% Profitability Boost

The Challenge

A mid-sized insurer faced spiraling claim costs and outdated risk models. Customers churned, and margins shrank.

Our Solution

Qubitstats deployed a custom machine learning suite, integrating telematics, geospatial data, and fraud detection. We retrained their pricing engine to reflect real-time risks and customer behaviors.

The Results

- Pricing Accuracy: Premiums aligned with risk, reducing overpayments by 18%.

- Fraud Reduction: Caught 25% more suspicious claims, saving $2M annually.

- Customer Satisfaction: Personalized policies lifted retention by 12%.

- Profitability: A 30% jump in under 18 months.

Qubitstats didn’t just give us tools—they gave us a competitive edge we didn’t know was possible.

Why Partner with Qubitstats? Your Competitive Edge

- AI & ML Expertise: Our data scientists—veterans of complex industries—build models that outpace off-the-shelf solutions.

- Custom Solutions: No cookie-cutter fixes. We craft analytics tailored to your data, goals, and customers.

- Scalable & Secure: From startups to giants, our cloud-based systems grow with you, backed by top-tier security.

- Proven Results: Industry awards and client wins—like our 30% profitability case—speak for themselves.

Take the Next Step: Transform Your Business Today

Ready to future-proof your auto insurance operation? Here’s how to start:

- Free Consultation: Let’s dive into your challenges and map out a data-driven solution.

- Live Demo: See our predictive models in action—watch risk scores update in real time.

- Join the Leaders: Partner with Qubitstats and align with insurers already reaping the rewards of advanced analytics.

Don’t let outdated pricing hold you back. Contact us to schedule your consultation. Your data has a story—let Qubitstats tell it right.